Updated 12/1/2022

- Update Dec 1, 2022

- EIDL Loan – Hardship Accommodation Plan: When your first payment is due in less than 60 days, you can request an accommodation where you will only pay 10% of the monthly payment amount for six months (potentially extended after that). Interest will continue to accrue.

- Update May 17, 2022:

- The portal is now closed. Borrowers who need copies of their loan documents can call 833-853-5638. Caweb.sba.gov is a good place to check the status of your existing loans.

- Update May 6, 2022 – See here.

- The SBA reported that the EIDL program is out of funds, so applications that are not yet approved, will not be processed or approved.

- The COVID-19 EIDL portal (covid19relief1.sba.gov, also known as the “RAPID portal”) will close on May 16, 2022. Borrowers should download their loan documents from the portal prior to this date.

As part of the CARES Act (03/27/2020), the SBA offers low-interest loans to eligible small businesses that were financially impacted by Covid-19. This includes both standard “businesses”, as well as self-employed individuals and non-profits. We will attempt to keep this post up-to-date. See “Changes” below to see the various changes that were introduced along the way.

This article is about the EIDL loan which needs to be paid back, Separately, there is an EIDL Grant that has different eligibility. The EIDL grant does not need to be paid back.

For more details, read the FAQ.

Table of Contents

- Business Eligibility

- How to Apply

- Loan Amount

- Requirements Based on Loan Size

- Reconsideration

- Interest Rate + Deferred Payment

- Request an Increase

- Spend the Funds

- Pay Back the Loan

- Hardship Accommodation Plan

- Changes

Business Eligibility

- Started on or before 1/31/2020

- Physically located in USA

- Suffered financially due to Covid-19 (“suffered working capital losses”)

- 500 or fewer employees – or over 500 employees and meets the alternate Size Standard. (Many hard-hit businesses can be eligible even if they have more than 500 employees, as long as they don’t have more then 500 employees per location, and also operate out of no more than 20 locations. To check if your business is on the list, see page 7 of this FAQ.)

How to Apply

- Apply Here

- New loan applications need to be submitted before 12/31/2021, but can be still be approved after 12/31/2021. Increases and appeals can still be submitted after 12/221/2021.

Loan Amount

The loan amount is meant to cover two years of “working capital” (sales), with a maximum loan amount of $2,000,000 (Loans over $500k will start to be processed from 10/08/2021).

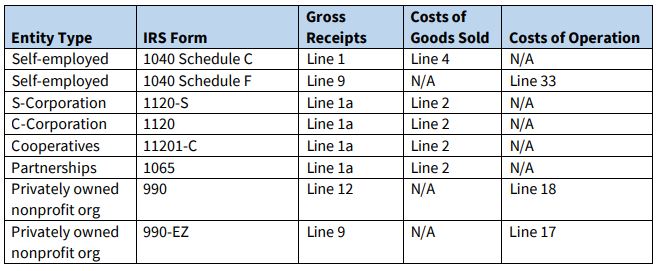

The standard calculation is “Gross Receipts” of 2019 minus cost of goods sold (COGS) times 2.

For example, if your total gross revenue was $50,000 and your COGS was $10,000, you should be eligible for up to an $80,000 loan. The loan may change based on answering the optional questions in the application.

Landlords with lost rental income generally get a loan amount double the lost rents in 2020 (or matching lost rents of 2020 and 2021).

Requirements Based on Loan Size

Loans Over $200k

SBA will also require an unsecured personal guarantee for loan amounts over $200,000 from any individual with 20 percent or more ownership. Non-Profits do not require a personal guarantee even if the loan is over $200k.

Loans over $500k

The SBA will require a much more detailed financial report and will likely require real estate collateral as well.

Minimum Credit Score

– Loans under $500k – Minimum 570

– Loans over $500k – Minimum 625

Reconsideration

If your application was declined, you can request a reconsideration within your portal.

If you don’t see the option to request a reconsideration within your portal, send an email to pdcrecons@sba.gov. Include your application number and any information required to overcome the reason for the decline.

If the decline letter requested specific information or documentation for reconsideration, you must include those items.

Be sure to include:

- Business Name

- Your Name

- Tax ID/EIN or SSN

- Application/Loan Number

- IRS Form 4506-T (form must be received within 120 days of the signature date)

- Consider including your 2019 business tax return as well.

If your application was declined due to you having bad credit (under 570), try raising your credit score before requesting a reconsideration.

Interest Rate + Deferred Payment

3.75% 30-year loan (2.75% for nonprofits).

The first payment is due 30 months after the loan was made (initial loan closing documents). Interest starts accruing from day 1 but is deferred for the first 30 months.

Request an Increase

1) Log into your EIDL portal and check if you have the option to “Request more funds”. (option added 04/22/2021)

2) Send an email (click for prefilled email which you can then edit as you choose) to CovidEIDLIncreaseRequests@sba.gov with the subject line “EIDL Increase Request for [insert your 10-digit application number]”

In the body of the email include your:

- Application number

- Loan number

- Business name

- Business address

- Business owner name (of any 20%+ owner)

- Phone number

Spend the Funds

“Working capital and normal operating expenses – Example: continuation of health care benefits, rent, utilities, fixed debt payments.”

Some options: payroll, rent, mortgage interest, and supplies.

How not to spend the money (not complete list): Bonuses, disbursements to owners that are not for work, purchasing equipment, relocation, repair physical damage, and paying off a previous large amount of credit card debt.

Pay Back the Loan

You can pay online at Pay.Gov. No pre-payment penalty.

Hardship Accommodation Plan

SBA is offering a Hardship Accommodation Plan for borrowers experiencing short-term financial challenges. Borrowers eligible for this plan may make reduced payments for six months. Interest will continue to accrue, which may increase (or create) a balloon payment due at the end of the loan term.

Terms

- Borrowers are required to pay at least 10% of their monthly payment amount (with a $25 minimum), for six months.

- During the Hardship Accommodation period, borrowers can voluntarily make larger payments.

- The regular monthly payment amount will resume and be required after the six-month Hardship Accommodation period ends. Borrowers may be able to renew the Hardship Accommodation Plan, if necessary.

Borrowers are eligible to enroll in the Hardship Accommodation Plan beginning 60 calendar days before their first payment due date.

- If your loan amount is less than or equal to $200,000: To enroll in the Hardship Accommodation Plan, create a CAFS account or log in to your existing account. Within CAFS, hover over “Borrower” and select “Borrower Search.” Select the appropriate loan number and request the Hardship Accommodation on the Loan Info page.

- If your loan amount exceeds $200,000: To apply, contact the COVID-19 EIDL Servicing Center at 833-853-5638 or disastercustomerservice@sba.gov (and include “Hardship Accommodation Plan” in the subject line). You will be contacted by a loan specialist regarding requirements.

Changes

- Maximum loan size: The original maximum loan amount was $150,000. On 03/24/2021, the SBA announced that beginning April 6 they will raise the maximum loan amount from $150k to $500k. On September 8, the SBA raised the maximum loan size to $2MM.

- Loan Calculation: Originally, the loan amount was calculated based on six months of gross income. This was changed (as part of the change from $150k to $500k) to two years of gross income.

- Business start date: The original requirement was that the business had to be in operation before 01/31/2020 – SBA changed the rules the date to 02/15/2020, but then seem to have changed it back to 1/31/2020.

- Deadline to apply: The original deadline was 12/31/2020 but was extended to 12/31/2021. The deadline was then changed again: Applications need to be approved by 12/31/2021 (considering that it can take months for applications to be approved, the deadline for applications is really much earlier than 12/31/2021), Then, at a hearing on 11/16, the SBA Administrator (Ms. Guzman) said that loan applications need to be submitted before 12/31, but can be still be approved after 12/31/2021.

- First payment due-date: Originally all loans had the first payment due 12 months after receiving the loan (with interest deferred for the first 12 months). On 03/12/2021 the SBA announced the changes: 2020 loans have 24 months until first payment due-date and 2021 loans have 18 months. On 9/8/2021. the SBA announced that all loans (including 2021 loans) will have their first payment due 24 months after receiving the loan (though as above, interest accrues during the 24 months). On 3/15/2021 the SBA announced that all loans will have their first payment due 30 months after initial loan Note.

- 2019 Gross Revenue vs 12 Months Pre-Pandemic: The orginal application showed that eligibility would be based on 12 months of gross revenue before 01/31/2021 (so 02/01/2019 – 01/31/2020). However, in the latest FAQ, it’s quite clear that the calculation is based on 2019 gross sales (01/01/2019 – 12/31/2019).

- Maximum Amount of Employees: On September 8 2021, the SBA added that many hard-hit businesses can be eligible even if they have more than 500 employees, as long as they don’t have more then 500 employees per location, and also operate out of no more than 20 locations. To check if your business is on the list, see page 7 of this FAQ.

- Requesting a Reconsideration: Until September 2021 if your loan was denied, the only way to request a reconsideration was via email. Towards the end of September the SBA added the option to request a reconsideration within the online portal.