This application tutorial is for Second Draw (second round) PPP for people who are self-employed and have a Schedule C/1099. If you already applied for the first round of PPP, you need our First Draw tutorial instead.

See more partner banks here.

For more information about PPP, visit our PPP Resource Center.

<Written in collaboration with ChaiPlus1>

Four Steps

1) Find your Schedule C

As part of your application, you will need to reference your Schedule C (either 2019 or 2020). This should be part of your tax return if you are self-employed/1099. We highlighted all the parts that you will need to complete your PPP application.

2) Find your First Draw Loan Number

You need your SBA Loan Number from your First Draw PPP.

You can get this information from which bank processed your First Draw PPP – you may have it as a Docusign in your email as well.

Here is a sample First Draw loan document with SBA Loan # and Amount.

3) Confirm Your 25% Reduction

Use our calculator to help calculate your 25% reduction in gross receipts in 2020.

4) Apply!

Start your application with our banking partner, Biz2Credit.

When you apply using our dedicated link, we will be in a position to help you along the way if you get stuck with your application for whatever reason.

This is the landing page. ‘Get Started Now’.

‘Continue to PPP Application’

Since this is your Second Draw application, select “Already Had a PPP Loan”.

- You need your SBA Loan Number from your First Draw PPP.

- Once you enter the loan number, the loan amount should be automatically filled.

- If you are affiliated with any other businesses, you are meant to include all their First Draw PPP loan numbers and amounts as well.

Here’s where you check if you’re eligible. So ‘Continue to Check Eligibility’.

Your answers should most likely look like this. (Assuming you were in business on Feb 15 2020, you were in operation all of 2019, you’re not a seasonal employer, you don’t have any employees, you are not in the restaurant or hotel business, and nope, you’re not a DMO or publically traded, and yes you do want to use gross income to calculate your PPP)

Details:

- In order to be eligible for a PPP, you must have been in operation as of February 15, 2020. If the answer here is “no”, you are not eligible.

- If your business was not in operation for the full year 2019, follow the instructions.

- Select “yes” if you are in operation for less than 7 months of each year, or if you earn three times more in six months of the year than the other half of the year.

- If you have employees, then you are using the wrong tutorial – you need the businesses with payroll tutorial

- If you are in the restaurant or accommodation business (and your NAICS starts with 72), you will get approximately 30% of your line 7 (or 31) instead of 20%!

- The answer is most likely “no”.

- The answer is “no”.

- If you want to calculate your PPP based on line 7 (gross income) click the first option. If you file a Schedule F (farm), click the second option.

Here is where you confirm that you had a 25% reduction from 2019 to 2020. If you had an annual 25% reduction from 2020 compared to 2019 (Lines 4+7 in 2020 is 25% less than lines 4+7 in 2019), then answer “Yes”. Otherwise, answer “No”.

If you answered “Yes” to annual reduction, enter your gross receipts from 2019 and 2020 to confirm that you had a 25% reduction.

If you answered “No” to annual reduction, enter your gross receipts from one quarter to confirm a 25% reduction in at least one quarter.

- From the drop-down, select “2019 Full Year” if using your 2019 Schedule C, and “2020 Full Year” if using your 2020 Schedule C.

- If you started operations after June 30, 2019 you also have the option of choosing Jan and Feb of 2020, but note that while you can base your PPP on Jan and Feb of 2020, forgiveness will ultimately depend on your filed 2020 Schedule C.

- For “Gross Income Divided by 12”, look at Line 7 of your Schedule C. Divide that number by 12 (then round up to the nearest whole dollar amount.)

Note: If you decided to apply based on net income, then divide line 31 by 12.

You’re eligible for PPP, great! This number is your line 7 (or 31) divided by 12, then times 2.5 ($20,833.33 is the maximum – even if you are eligible for more based on your line 7). If you are in the food and accommodation services (NAICS code 72), then your maximum PPP is $29,167.

- Business Legal Name is line C on your Schedule C (see sample above). If it’s blank, enter your own legal name.

- If you don’t have a “business” phone number, simply enter your phone number

- Business Address is the address listed on Line E of your Schedule C (see sample above). If there is no address listed on your Schedule C, use your home address.

- Your NAICS code is a 6 digit code located on line B of your Schedule C. If this is a generic code like 999999 or one that does not come up when typed into the field, start typing the name of your profession, and you’ll be given a list of choices. Choose the one that fits best.

- If you receive a 1099 for your work, select “independent contractor”. If you do not receive a 1099, select “sole proprietorship”.

- If you’re unsure of when you first started working on your 1099/Schedule C, do your best to estimate.

- Check line D of your Schedule C (see sample above). If this line is blank, select the checkbox “My business doesn’t have an EIN”. If your Schedule C does have an EIN, enter it here.

- If you don’t have an EIN, check the checkbox.

- As self-employed the answer here is most likely “no”.

Remember, you’re the owner of your business. So this should be fairly simple. If your “business” and “home” address are the same, then you can check “Use business address”.

- Leave unchecked

- If unsure, choose “owner”

- Your social security number

- If unsure, choose “Business Owner” and leave business ownership at 100%

- Purpose of Loan: Check the box ‘Payroll expenses’. If your Schedule C normally includes expenses (line 28), then you can choose other expenses as well (I don’t think it matters that much what you include in “Purpose of Loan”.

- Read the other questions – the ones chosen above are the most common answers.

If you answer yes to any of these questions, you are not eligible for PPP.

Now upload your required documents

Documents to upload:

1) Schedule C (2019 or 2020 – whichever one you are using)

2) Bank Statement from February 2020

3) Front and back of license (or passport)

4) Voided check (blank check with the word “VOID” written across the check)

If you don’t have a blank check, then upload a letter from the bank with your account, and routing number is shown.

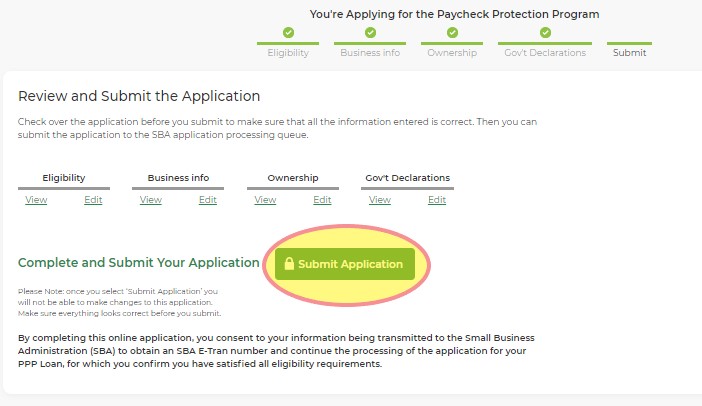

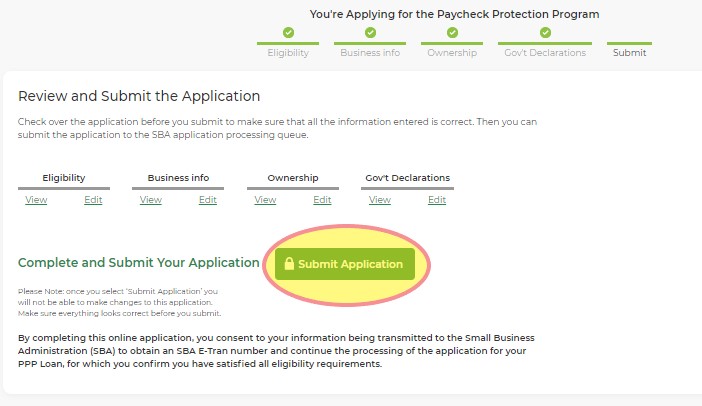

Voila! You are all set!

After You Apply

- Biz2Credit will check your application and then submit it to the SBA

Once your application is approved by the SBA (this

This application tutorial is for Second Draw (second round) PPP for people who are self-employed and have a Schedule C/1099. If you already applied for the first round of PPP, you need our First Draw tutorial instead.

Ready to apply? Use our dedicated Biz2Credit portal, and we can help if you encounter any issues!.

For more information about PPP, visit our PPP Resource Center.

<Written in collaboration with ChaiPlus1>

Four Steps

1) Find your Schedule C

As part of your application, you will need to reference your Schedule C (either 2019 or 2020). This should be part of your tax return if you are self-employed/1099. We highlighted all the parts that you will need to complete your PPP application.

2) Find your First Draw Loan Number

You need your SBA Loan Number from your First Draw PPP.

You can get this information from which bank processed your First Draw PPP – you may have it as a Docusign in your email as well.

Here is a sample First Draw loan document with SBA Loan # and Amount.

3) Confirm Your 25% Reduction

Use our calculator to help calculate your 25% reduction in gross receipts in 2020.

4) Apply!

Start your application with our banking partner, Biz2Credit.

When you apply using our dedicated link, we will be in a position to help you along the way if you get stuck with your application for whatever reason.

This is the landing page. ‘Get Started Now’.

‘Continue to PPP Application’

Since this is your Second Draw application, select “Already Had a PPP Loan”.

- You need your SBA Loan Number from your First Draw PPP.

- Once you enter the loan number, the loan amount should be automatically filled.

- If you are affiliated with any other businesses, you are meant to include all their First Draw PPP loan numbers and amounts as well.

Here’s where you check if you’re eligible. So ‘Continue to Check Eligibility’.

Your answers should most likely look like this. (Assuming you were in business on Feb 15 2020, you were in operation all of 2019, you’re not a seasonal employer, you don’t have any employees, you are not in the restaurant or hotel business, and nope, you’re not a DMO or publically traded, and yes you do want to use gross income to calculate your PPP)

Details:

- In order to be eligible for a PPP, you must have been in operation as of February 15, 2020. If the answer here is “no”, you are not eligible.

- If your business was not in operation for the full year 2019, follow the instructions.

- Select “yes” if you are in operation for less than 7 months of each year, or if you earn three times more in six months of the year than the other half of the year.

- If you have employees, then you are using the wrong tutorial – you need the businesses with payroll tutorial

- If you are in the restaurant or accommodation business (and your NAICS starts with 72), you will get approximately 30% of your line 7 (or 31) instead of 20%!

- The answer is most likely “no”.

- The answer is “no”.

- If you want to calculate your PPP based on line 7 (gross income) click the first option. If you file a Schedule F (farm), click the second option.

Here is where you confirm that you had a 25% reduction from 2019 to 2020. If you had an annual 25% reduction from 2020 compared to 2019 (Lines 4+7 in 2020 is 25% less than lines 4+7 in 2019), then answer “Yes”. Otherwise, answer “No”.

If you answered “Yes” to annual reduction, enter your gross receipts from 2019 and 2020 to confirm that you had a 25% reduction.

If you answered “No” to annual reduction, enter your gross receipts from one quarter to confirm a 25% reduction in at least one quarter.

- From the drop-down, select “2019 Full Year” if using your 2019 Schedule C, and “2020 Full Year” if using your 2020 Schedule C.

- If you started operations after June 30, 2019 you also have the option of choosing Jan and Feb of 2020, but note that while you can base your PPP on Jan and Feb of 2020, forgiveness will ultimately depend on your filed 2020 Schedule C.

- For “Gross Income Divided by 12”, look at Line 7 of your Schedule C. Divide that number by 12 (then round up to the nearest whole dollar amount.)

Note: If you decided to apply based on net income, then divide line 31 by 12.

You’re eligible for PPP, great! This number is your line 7 (or 31) divided by 12, then times 2.5 ($20,833.33 is the maximum – even if you are eligible for more based on your line 7). If you are in the food and accommodation services (NAICS code 72), then your maximum PPP is $29,167.

- Business Legal Name is line C on your Schedule C (see sample above). If it’s blank, enter your own legal name.

- If you don’t have a “business” phone number, simply enter your phone number

- Business Address is the address listed on Line E of your Schedule C (see sample above). If there is no address listed on your Schedule C, use your home address.

- Your NAICS code is a 6 digit code located on line B of your Schedule C. If this is a generic code like 999999 or one that does not come up when typed into the field, start typing the name of your profession, and you’ll be given a list of choices. Choose the one that fits best.

- If you receive a 1099 for your work, select “independent contractor”. If you do not receive a 1099, select “sole proprietorship”.

- If you’re unsure of when you first started working on your 1099/Schedule C, do your best to estimate.

- Check line D of your Schedule C (see sample above). If this line is blank, select the checkbox “My business doesn’t have an EIN”. If your Schedule C does have an EIN, enter it here.

- If you don’t have an EIN, check the checkbox.

- As self-employed the answer here is most likely “no”.

Remember, you’re the owner of your business. So this should be fairly simple. If your “business” and “home” address are the same, then you can check “Use business address”.

- Leave unchecked

- If unsure, choose “owner”

- Your social security number

- If unsure, choose “Business Owner” and leave business ownership at 100%

- Purpose of Loan: Check the box ‘Payroll expenses’. If your Schedule C normally includes expenses (line 28), then you can choose other expenses as well (I don’t think it matters that much what you include in “Purpose of Loan”.

- Read the other questions – the ones chosen above are the most common answers.

If you answer yes to any of these questions, you are not eligible for PPP.

Now upload your required documents

Documents to upload:

1) Schedule C (2019 or 2020 – whichever one you are using)

2) Bank Statement from February 2020

3) Front and back of license (or passport)

4) Voided check (blank check with the word “VOID” written across the check)

If you don’t have a blank check, then upload a letter from the bank with your account, and routing number is shown.

Voila! You are all set!

After You Apply

- Biz2Credit will check your application and then submit it to the SBA

- Once your application is approved by the SBA (due to added checks and manual reviews, this part can take a few days) you should receive a DocuSign to sign your PPP application.

- You will also receive a notification to add your ACH details (upload your voided check).

- After submitting your signed application and ACH details, the underwriting team will do some more checks to see if they can approve your application (can take another few days).

- Once approved (hopefully!), you will receive a second DocuSign (from Itria Ventures – Biz2Credit’s bank) with your PPP offer.

- Within a few hours of accepting your offer, you’ll be funded!