Unemployment offers weekly payments for people who are not working full time. This article explains how taxes affect your Unemployment payments.

Table of Contents

- Taxes on Unemployment Payments

- Withholding Taxes

- To Withhold or Not to Withhold

- NY Guide: Your Tax Options and 1099-G

Taxes on Unemployment Payments

Everyone must pay Federal taxes on Unemployment payments. State taxes depend on the state (NY and NJ both tax Unemployment).

For 2020, if you earned under $150k, the first $10,200 in Unemployment is tax-free ($10,200 per spouse if “married filing jointly”).

“Standard payments” and “bonuses” are both taxable.

- Standard payments

- Weekly payments, either regular Unemployment (UI) or Pandemic Unemployment Assistance.

- Bonuses

1099-G

Every January, each state’s Unemployment department provides a Form 1099-G, which includes the total of all your Unemployment payments from the previous year as well as how much federal and state taxes were withheld for taxes. This 1099-G must be included in your tax return.

Withholding Taxes

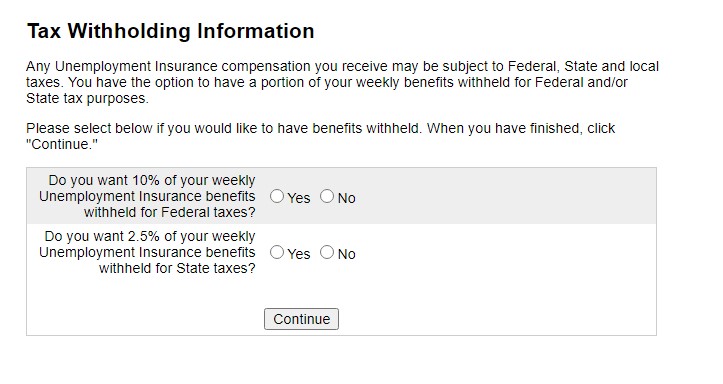

When you apply for Unemployment, you choose whether to have 10% withheld for federal taxes. There is no option to have less or more than 10% withheld for federal taxes. You may also have the option to have state taxes withheld (at whatever rate is decided by your state). You can also decide not to have any (federal or state) taxes withheld if you want to take care of paying the taxes on your own.

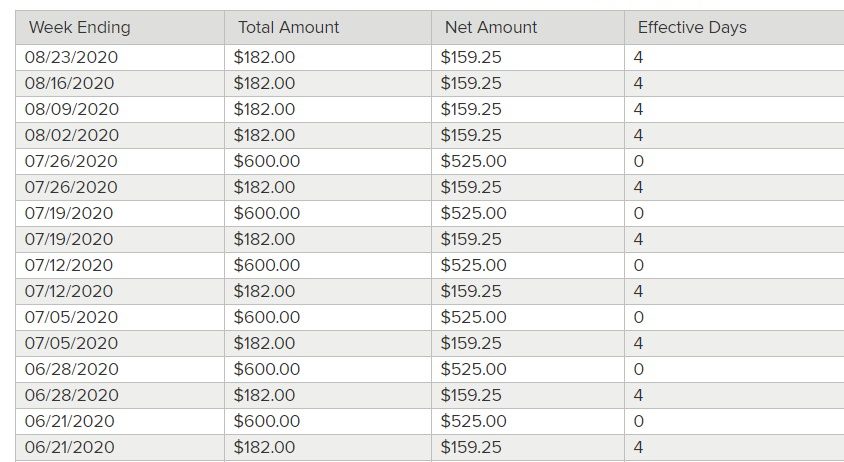

In NY, for example, you are given an option to have 2.5% withheld for state taxes (in addition to the 10% federal). If you choose to have both Federal and NY State taxes withheld, 12.5% is deducted from all Unemployment payments. For example $600 – 12.5% = $525, $182 -12.5% = $159.25.

Either way, you pay taxes. The only question is if your state’s Unemployment agency withholds it for you or you pay when you file.

The exact amount you will owe depends on many individual-specific circumstances during the entire year (how much you earned besides Unemployment, how many dependents you have, and other variables). Depending on circumstances, many people will actually owe less than 10% in taxes for Unemployment payments, or in fact nothing at all, while others may owe more than 10%. If you have the 10% deducted and you owe less than that, you will get the difference as a refund. If you owe more, then you will need to pay more.

Being that Unemployment payments are considered “unearned income”, minors and dependents who received more than $1,100 in Unemployment need to file their own return.

To Withhold or Not to Withhold?

If you are unsure of your tax situation, you’re better off withholding for two reasons:

- Better to get less now and not worry about owing the IRS when you file 2020 taxes. If you had taxes withheld when you did not need to, you will get a refund when you file your 2020 taxes. No harm done, and you will enjoy a nice chunk of a refund 🙂

- If you don’t withhold, you run the risk of owing the IRS money when you file your 2020 taxes. If that were to happen, the IRS may penalize you for not paying taxes during the year when you actually earned the money. So it’s safer to have taxes withheld to minimize any chances of having to pay a penalty.

If you are sure of your tax situation (or have access to your accountant), then you can make an educated decision as to whether to withhold or not. If you know that you won’t owe any taxes and will definitely be getting a big enough refund to balance out any taxes you may owe from your Unemployment payments, then the benefit of not withholding your taxes is that you get extra money now. There is no point in giving the IRS an interest-free loan.

NY Guide: Your Tax Options and 1099-G

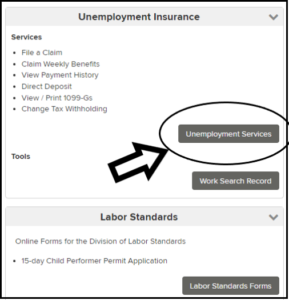

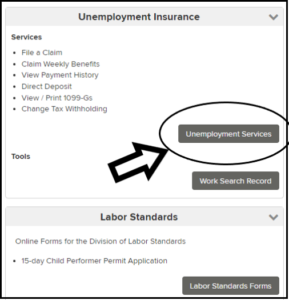

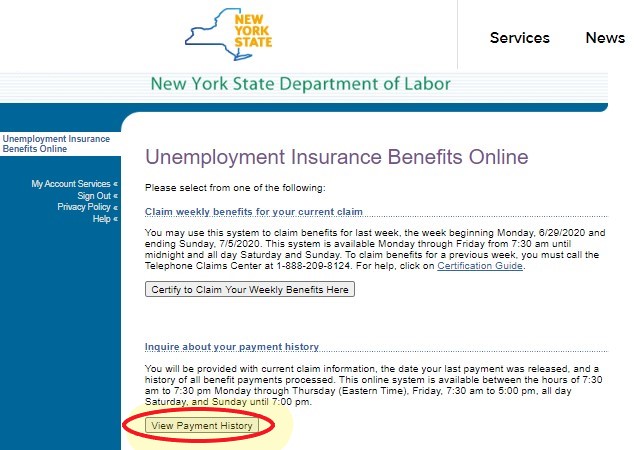

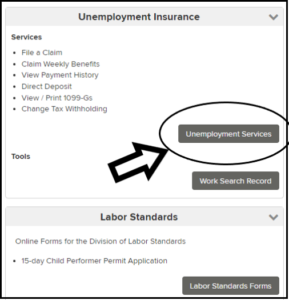

How to check if taxes are being withheld

In NY you have the option to have withheld 10% for federal and 2.5% for state taxes.

How to change your tax withholding choice

You can switch between having taxes withheld or not, but only for future payments, not retroactive.

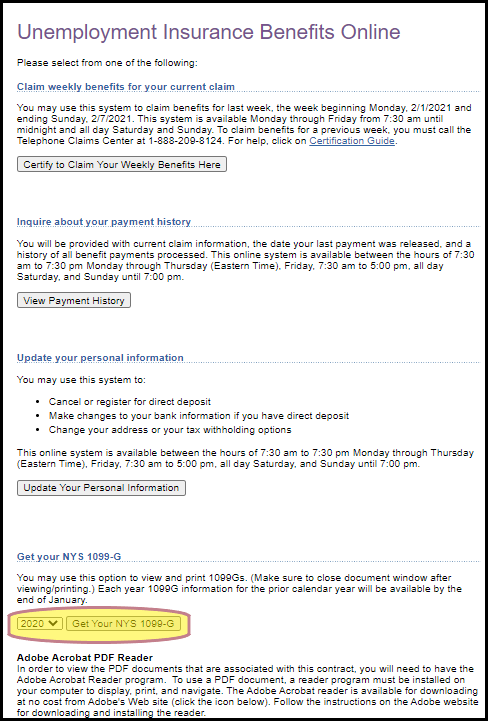

How to get your 1099-G form