Originally published December 3, 2020. Last updated December 1, 2021.

The primary focus of this site is Covid-related financial assistance, both individual assistance and business grants & loans. However, aside from Covid, there are too many people who could benefit from various programs, but simply have no idea that they exist.

If you need help but have no idea what’s available, this list is for you. Although many programs are specific to NY, lots of others are available nationwide. This list is not comprehensive, but enough to make you aware of what each program offers and to serve as a starting point to check if there is something worth pursuing.

The “ease of use” guesstimates how complex the program or application is. The “easy” ones should be quick and simple, the “moderate” ones will take some time and effort and the “complex” ones are more complex 🙂 and you might want help with them. For some programs, we added a “value” line to estimate what you can expect to get from the program. The programs that are Covid-specific were noted as such.

Some have no income requirements and we’ve made that clear by each of those programs. The income requirements are different for each program, for example, a family of 7 can earn over $80k annually and still get HEAP, even if they wouldn’t be eligible for Medicaid. While most of these programs are “benefits” for those struggling financially, some, like PFL (discussed below), are not.

We hope you find something that helps you out financially. More than that, we hope that your financial situation changes soon and that you will no longer be in need of income-eligible programs. Lastly, if you know of a helpful program that is not on the list, please share!

Note: Although we will periodically update the list, expired programs may remain on the list for some time after expiration.

<In collaboration with ChaiPlus1.com>

Table of Contents

- Heating, Cooling and Home Maintenance

- Internet and Phone

- Food

- Travel, Leisure, Shopping and Learning

- Childcare

- Work-Related

- Health

- Home Purchase / Mortgage / Rent

- Further Assistance

Heating, Cooling and Home Maintenance

COVID – Low Income Household Water Assistance Program (LIHWAP)

The Low Income Household Water Assistance Program (LIHWAP) helps low-income households pay the cost of drinking water and wastewater services. The program can assist households who have past due bills (arrears) for drinking water and/or wastewater services.

LIHWAP will pay all the arrears, up to a maximum of $2,500 per drinking water or wastewater provider, or $5,000 if drinking water and wastewater services are combined (like NYC), per applicant household. Benefits are paid directly to the household’s drinking water and/or wastewater vendor(s)

See more information here. For more information, call 1-800-342-3009 or email NYSLIHWAP@otda.ny.gov.

How to Apply

You will need to include the following documentation along with your application:

- Proof of identity for the primary applicant.

- A valid Social Security Number for the primary applicant.

- Proof of residence.

- A drinking water, wastewater, or combined drinking water and wastewater bill listing your permanent and primary residence.

- Documentation of income for the primary applicant.

Eligibility Criteria

- Citizinship Status

You or a member of your household must be a Citizen, U.S. National, or qualified alien - Income Eligbility

If any of the below apply to you, then you are “income eligible”- Your household’s gross monthly income is at or below the current income guidelines for your household size as posted in the table below

- You receive Home Energy Assistance Program (HEAP) benefits

- You receive Supplemental Nutrition Assistance Program (SNAP) benefits

- You receive Temporary Assistance (TA)

- You receive Code A Supplemental Security Income

- Water or Sewer Bill

- You pay a vendor directly for your drinking water and/or wastewater usage

and - Your drinking water, wastewater, or combined drinking water and wastewater account is twenty (20) days past the due date, you have a water lien that is levied on your local property taxes, or your drinking water, wastewater, or combined drinking water and wastewater service is terminated or otherwise facing disconnection due to unpaid arrears.

- You pay a vendor directly for your drinking water and/or wastewater usage

| Household Size | Maximum Gross Monthly Income |

|---|---|

| 1 | $2,729 |

| 2 | $3,569 |

| 3 | $4,409 |

| 4 | $5,249 |

| 5 | $6,088 |

| 6 | $6,928 |

| 7 | $7,086 |

| 8 | $7,243 |

| 9 | $7,401 |

| 10 | $7,558 |

| 11 | $7,715 |

| 12 | $7,873 |

| 13 | $8,420 |

| Each additional | Add $568 |

COVID – Funding for Heating Utility Bill Arrears

On September 22, 2021, Governor Hochul announced $150 million in funding for those that are behind on their heating utility bill but are not eligible for Emergency Rental Assistance (ERA).

The funding will cover the full balance of the heating utility bill, up to $10,000.

This is helpful to those who have fallen behind on their heating bill, but are not eligible for ERA, as they either own their home or do not owe rent.

More information here.

Are You Eligible?

- You heat your home with natural gas or electricity, and/or

- Your heating costs are included in your rent, but you are responsible for paying for your home’s electricity,

and

- Your income is at or below the current income guidelines as posted in the table above or you receive Family Assistance, Safety Net Assistance, Supplemental Nutrition Assistance (SNAP) or Code A Supplemental Security Income,

- You received, or meet all of the eligibility criteria to receive, a Regular HEAP benefit in the current program year,

- You pay a vendor directly for your gas and/or electricity usage, and

- Your current gas and/or electricity account(s) is/are in active collections, or otherwise facing disconnection or termination due to unpaid arrears.

- Ease of use: Moderate **

- Value: Depending on your bill. Maximum $10k.

EmPower Home Insulation

- Insulate your house, including wall insulation, draft proofing windows and doors, replacing inefficient fridges and freezers, and changing light bulbs.

- For renters and homeowners who are income-eligible.

- Ease of use: Moderate **

- Value: We haven’t seen an upper limit to the value. Depends on the work needed to insulate your home – anywhere from $100 to S10k+.

National Grid – Total Home Comfort – 60% Off Home Insulation

- Great if you are either not eligible for EmPower or you are looking to have more control over the insulation process

NYC: Lead Reduction and Healthy Homes Program

- The Lead Hazard Reduction and Healthy Homes – Primary Prevention Program (PPP), a joint initiative between New York City Department of Housing Preservation and Development (HPD) and the Department of Health and Mental Hygiene (DOHMH), offers federally-funded grants for reduction of lead paint hazards and other health risks to owners of residential buildings constructed prior to 1960.

- Ease of use: Moderate **

- Value: “Grants average $8,000 – $10,000 per apartment”

LED Light Bulbs – Con Edison

- Replaces non-LED bulbs with LED equivalents in select Brooklyn and Queens neighborhoods, but the program is temporarily suspended, so use Empower instead.

- For renters and homeowners, no income requirements.

- Ease of use: Easy*

- Value: Depends on how many lightbulbs you have in your house 🙂

Con Edison Discounted Electric Rate

- Receive a discount rate for electricity if you are on an eligible government program (e.g. HEAP or Medicaid).

- Although the discounted rate is meant to happen automatically, it is best to submit proof of your eligible program enrollment (e.g. acceptance letter to SNAP or HEAP) to Con Edison, as reports are that Con Edison takes time to apply the discounts. Submit your proof via email (lowincomerate@coned.com), fax (212-844-0110) or mail (Con Edison PA Central 4 Irving Place, 9 Floor Box 13 New York, NY 10003)

- For renters and homeowners

- Ease of use: Easy *

- Value: approx $10-20 per month, though once registered, you also don’t pay peak pricing for electricity, potentially saving substantially more.

National Grid – Discount on Your Gas Bill

- National Grid’s Energy Affordability Program (EAP), like Con Edison, gives you a discounted rate if you are income-eligible or are signed up for HEAP.

- Send a completed application via email (EAPNY@nationalgrid.com) or mail (Attn: Energy Affordability Program, National Grid, 1 MetroTech Center, Floor 13E, Brooklyn, NY 11201)

- Ease of use: Easy *

HeartShare – Neighborhood Heating Fund – $200 Towards Heating

- If you used your HEAP allowance and need more help, you may be eligible for an additional $200 per winter.

- Ease of use: Moderate **

- Value: $200 per winter

COVID – NYS Utility Shutoff Moratorium

- During Covid, utility companies are not allowed to turn off utilities due to non-payment.

- For renters and homeowners who are having difficulties paying their utility bills due to Covid.

HEAP (Home Energy Assistance Program)

Note: All the HEAP programs are for income-eligible people. Even if you earn too much for Medicaid, you may be eligible for HEAP, as the income allowance is higher than SNAP or Medicaid.

- HEAP: Cooling

- Air conditioner (including free installation); if you don’t have any air conditioners newer than 5 years old

and you have a documented medical need for cooling devices. - Starting with summer 2022 (applications are open May 2 – Aug 31) a medical condition is no longer a requirement.

- For renters and homeowners

- Ease of use: Moderate **

- Value: up to $800

- Air conditioner (including free installation); if you don’t have any air conditioners newer than 5 years old

- HEAP: Heating

- Gives a few hundred dollars towards heating costs once a year.

- For renters and homeowners

- 2021-2022: The HEAP benefit opened October 1, 2021. The deadline to submit applications is March 15, 2022.

- In NYC see here for more info and here is the application. Mail the completed application to New York City Home Energy Assistance Program, P.O. Box 1401, Church Street Station New York, NY, 10008.

- Ease of use: Moderate **

- Value: $300-$800 per winter

- COVID – HEAP: Emergency HEAP

- For households who receive a shut-off notice and have very limited savings.

- The 2021-2022 Emergency benefit opened on January 3, 2022.

- Second benefit: Beginning February 22, 2022, a second Emergency benefit is available for households who have exhausted both the Regular and first Emergency HEAP benefits and who are in a heat or heat-related energy emergency, as defined by HEAP, and who meet the eligibility guidelines for Emergency benefit assistance.

- Third benefit: Beginning May 2, 2022, a third Emergency benefit is available for households who have exhausted both the Regular and first two Emergency HEAP benefits and who are in a heat or heat-related energy emergency, as defined by HEAP, and who meet the eligibility guidelines for Emergency benefit assistance.

- Even though utilities can’t be shut off during COVID, if you get threatened with a shutoff it’s enough for Emergency HEAP.

- For renters and homeowners

- Special for COVID

- Ease of use: Moderate **

- Value: $140-$675 per winter

- HEAP: Boiler Repair or Replacement

- Repair or replacement of your boiler

- Only for homeowners

- Ease of use: Moderate **

- Value: up to $6,500

- HEAP: Clean/Tune Heating Equipment

- Cleaning of primary heating equipment, chimney, minor repairs, installation of carbon monoxide detectors or programmable thermostats once in 12 months.

- Only for homeowners

- Ease of use: Moderate**

- Value: Up to $400

How to Apply:

Call or go in person to your local HEAP offices.

A list of local offices by county can be found here. Residents outside of New York City may also apply online for regular heating assistance benefits. New York City residents may download an application and obtain program information here.

Internet and Phone

Lifeline

- What is Lifeline?

- Lifeline is a federal program that provides funds towards internet, landline, or cell phone for people who are income-eligible. You can choose one discount (either telephone or internet) per household.

- Use Lifeline National Verifier to verify your eligibility. Check what Lifeline options are available in your area.

- Usually, Lifeline offers $9.25 off your monthly bill, but below are some promotions.

- Ease of use: Easy*

- Internet: Verizon High-Speed for $19.99

- Verizon is currently running a promotion: $20 off per month. Their standard $39.99 plan would be $19.99 per month.

- Confirm your eligibility with Lifeline National Verifier,

- Order Verizon Fios(our affiliate link – make your own cashback account to get your own cashback instead).

- Once your internet is up and running, call Verizon to activate the $20-off-a-month promotion.

- Value: $20 per month

- Ease of use: Easy *

- Verizon is currently running a promotion: $20 off per month. Their standard $39.99 plan would be $19.99 per month.

- Other Phone and Internet Options

- There are a few options for discounted or free cellphone service (besides for Verizon), including Assurance Wireless, Safelink and Qlinkwireless (We don’t have specific recommendations. If you have experience with any of these companies, please share).

- If you are looking for internet out of NYC, check Comcast and Spectrum as well.

Emergency Broadband Benefit – $50 Off Per Month

- Emergency Broadband Benefit is a federal program that provides a $50 discount off your monthly internet bills (or mobile phone plans that include internet) for eligible households, plus a one-off $100 credit for purchasing a device.

- NEW : The $50 discount will change to a $30 discount in March 2022. Stay tuned.

Food

- SNAP (Supplemental Nutrition Assistance Program – Food Stamps)

- Monthly food budget for income-eligible people. The amount you receive depends on your income and family size. Here is the max amount for family size.

- In NYC, use HRA Access to apply

- Value: $40-$1,224+ per month

- Ease of use: Moderate **

- COVID – COVID & SNAP

- Automatically receive the maximum: During Covid, Emergency Allotment means that if you’re eligible for any amount of SNAP, you get the max for your family size even if you’re eligible for less based on household income. So, if your income makes you just about eligible and as such you’d usually only get a few dollars a month, you’d now get the maximum amount for your family size ($200-1200+).

- 15% Increase: The Recovery Relief Bill (12/27/2020) includes a 15% increase to all SNAP payments from 01/01/2021-06/30/2021. The maximum allotment together with the 15% increase means each eligible family would get based on their family size:

- 1 person – $234

- 2 people – $430

- 3 people – $616

- 4 people – $782

- 5 people – $929

- 6 people – $1,114

- 7 people – $1,232

- 8 people – $1,408

- For each additional person, add $176

- Fewer requirements: In general, barring certain exceptional circumstances, one needs to work to get SNAP. During Covid, work requirements are waived. (1) A student is eligible if they are eligible to participate in state or federal work-study, regardless if the student is actively employed or participating in work-study; and (2) Any student that has an “expected family contribution” of $0 may participate in SNAP if otherwise eligible

- Value: The difference between your regular monthly SNAP amount and the maximum for your family size.

- Ease of use: Easy * – You should automatically receive the maximum each month that the program is running.

- WIC (Women Infants Children)

- Monthly budget for food for expectant women and children under 5.

- You get a card to use for specific items at participating stores.

- Has a higher income limit than SNAP. Don’t need to be a citizen to get it.

- During Covid, in-person appointments were replaced with phone calls, making it painless.

- Ease of use: Moderate **

- Value: approx $100-$300 per month

- COVID – P-EBT (Pandemic Electronic Benefit Transfer Program)

- $420 per child due to forced school closures. The $420 should have automatically been sent for all children who receive free or reduced-price school lunches. Many schools include all their students in this program (even if you are not income eligible).

- Get SNAP or Medicaid? It’s on your EBT or CBIC (Medicaid) card. Not on Medicaid/SNAP? You get a separate card with the money per child. (Some children under 5 in SNAP or Medicaid households did not receive benefits to their existing EBT/CBIC cards, but instead received one in the mail.)

- March-June 2020

- If you used up the money, don’t throw out the card! There may be more funds added for this (2020-2021) school year.

- Didn’t receive the funds? Call 833-452-0096. If they can’t help you, call your child’s school, so the school can check on their end if they submitted your child’s name.

- 2020-2021 School Year

- $5.86 per child per eligible day.

- Funds should be sent “no sooner than March 2021“

- March-June 2020

- Value: $5.70 per child per day for March-June 2020 ($420 total per child) and $5.86 per child per day for 2020-2021 school year.

- Ease of use: Easy * The funds should be sent to you automatically.

- Food Banks

- Find a location near you to pick up free food.

- Ease of use: Easy *

COVID – Free Food for Seniors – NYCFood packages delivered twice a week for free now during COVID.Currently not available for new applicants.

COVID – Grab and GoBagged breakfasts and lunches available for pickup for free, no income verification required.Ease of use: Easy *

Travel, Leisure, Shopping and Learning

- Cool Culture

- Card for parents and teachers of students in low-income preschools, providing free access to many museums and attractions for 5 people including the cardholder. You get it from your school.

- Revel Access – Moped Rentals

- Revel has rent-by-the-minute electric bikes in NYC

- If you receive government assistance (Medicaid etc), you get a 40% discount off all your rentals. First sign up (Please use our referral code: rkdjcm), then apply for the 40% discount.

- You can also get a free helmet (just pay $10 for shipping).

- Ease of use: Easy *

- Citi Bike Rentals

- $5 a month membership for those who receive SNAP or are NYCHA residents.

- Ease of use: Easy *

- 50% Off NYC Subway and Bus Rides

- Income-eligible people get 50% off subway and bus rides.

- Ease of use: Easy *

- Shopping

- 50% off Amazon Prime if you receive government assistance

- SNAP can be used on Amazon and many other stores.

- Ease of use: Easy *

- Earn Cashback on your Purchases

- Learn how to earn cashback whenever you shop.

- Ease of use: Easy *

- NYC ID

- Card provided to any resident of NYC, provides free access to many museums and attractions for cardholders, and discounted admission for additional visitors.

- Ease of use: Easy *

- Diaper Banks

- Diaper banks work similar to food banks, and provide diapers to families in need.

- Ease of use: Easy *

- COVID – DMV Online Services

- NY DMV expanded online services, to minimize location traffic. A host of transactions can now be completed online, including renewing your license and registering your vehicle.

- Also, all driver licenses and permits that expired March 1, 2020, or after are extended through January 1, 2021, and the federal REAL ID enforcement deadline has been extended until

October 1, 2021May 3, 2023. - Ease of use: Easy *

- COVID – Coursera Free Membership

- Online training platform with 4,000 courses to learn new skills and earn certificates.

- Free if you’re unemployed due to COVID-19.

- Ease of use: Easy *

Childcare

ScholarshipFund.org

- Pays towards private school tuition for income-eligible people.

- The program allows you to choose your own private school. In NYC, you can only choose from participating private schools.

- Value: $3,200 a year per child.

- Ease of use: Moderate **

Dependent Care Credit

- Up to 50% off eligible childcare expenses in 2021.

COVID – Free Childcare in New York – Essential Worker Scholarship

- The $25 Million NYS Essential Worker Scholarship fund covers childcare costs for essential workers. The term “essential worker” is very broad and includes childcare, education, retail, medical, construction and many more fields.

Childcare in Lieu of Cash Assistance

- Childcare in Lieu of Cash Assistance (CILOCA), part of NYC’s Cash Assistance (aka Temporary Assistance in NY State or TANF nationwide), which helps income-eligible people for up to 60 months. We haven’t seen published income level eligibility, but it is likely quite low.

- CILOCA pays towards childcare costs for income-eligible people to allow parents to work.

- It either funds full days of preschool or out-of-school hours, (e.g. after-care from 2:30pm), for older children.

- In NYC, use HRA Access to apply first for Cash Assistance together with SNAP/Medicaid, then add on the childcare component.

- Value: $5,000+ a year per child. Generally until the end of elementary school, but can potentially be extended into high school.

- Ease of use: Complex ***

Work-Related

COVID Unemployment

- If there was any time between March 2020 until now that you were not working full time, you’re likely eligible.

- Update September 6, 2021: Covid Unemployment is Over

- Value: Average 10k-30k

- Ease of use: Moderate **

COVID – NYS COVID-19 Sick/Quarantine Leave

- 5 days of paid leave if your boss employs 11-99 employees.

- 14 days of paid leave if your boss employs 100+ employees.

- After exhausting NYS COVID-19 Sick/Quarantine Leave, one is eligible for PFL and Temporary Disability.

- Value: 1-3 weeks worth of salary, so it depends on your salary 🙂

- Ease of use: Moderate **

- COVID – FFCRA – Families First Coronavirus Response Act (2020)

- Paid covid-related sick/quarantine/childcare leave up to 12 weeks.

- Depending on the reason for leave, employees receive full pay or 2/3 of pay.

- Self-Employed and Employees are eligible.

- Value: Up to $12,000 per person

- Ease of use: Moderate **

Paid Family Leave

- Both parents can take up to 10 weeks of Paid Family Leave upon the birth of a new baby.

- In 2021, >leave increases to 12 weeks. 67% of weekly wages, capped at $971.61/week.

- Leave can be taken intermittently within the first 12 months of the child’s birth. That means you can take off a day, a few days or a few weeks in a row, as you wish, until your baby turns one.

- Employers must offer you the same or a comparable position upon return, and must also offer continued health Insurance while on leave.

- You pay for this program, so be sure to take advantage! Check your paycheck stubs, you’ll see a line that says PFL and a number. That’s how much you’re paying for PFL every month.

- You can also use Paid Family Leave to care for loved ones who are ill.

- Value: Up to $11,719.32 per parent (so $23,438.64).

- Ease of use: Moderate **

NYC Sick Leave

- 40 hours of paid sick leave annually if your boss employs 5 or more employees. Leave is unpaid if 4 employees or less. These are the rules in NYC for 2020. In 2021, NYC will follow NYS rules – see below.

- Value: Depends on your salary. Approx 1 week for full-timers.

- Ease of use: Moderate **

NYS Sick Leave (2021)

- 40 hours of paid leave if your boss employs 5-99 employees.

- 56 hours of paid leave if your boss employs 100+ employees.

- 40 hours of unpaid leave if your boss employs 1-4 employees (unless business income is above $1M, in which case leave is paid).

- Value: Again, depends on your salary. Approx 1 week for full-timers.

- Ease of use: Moderate **

Health

- Medicaid

- Free health insurance if you are income-eligible (Link 1 and link 2).

- During the pandemic, you stay eligible even if your income goes up.

- In NYC, use HRA Access to apply

- Ease of use: Moderate **

- CHIP/Child Health Plus/Family Health Plus

- Low-cost health insurance when you earn too much for Medicaid.

- Ease of use: Moderate **

- NYS Marketplace (Open Enrollment)

- Check your eligibility and also see your options if you earn too much for free or cheap insurance.

- Ease of use: Moderate **

Home Purchase / Mortgage / Rent

COVID – Up to $50k Towards Mortgage and Other Housing Bills!

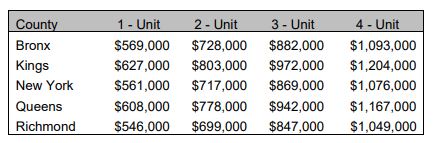

NYC – $100k Towards Down Payment – HomeFirst Down Payment Assistance Program

Up to $100,000 towards a down payment for income-eligible first-time homebuyers. Full details here. (Amount was raised from $40k to $100k on 10/01/2021). It’s challenging, but possible, to find a property with a purchase price lower than the maximum allowable.

Note: As this is a federaly funded program, if you want to purchase a home out of New York City, look up potential programs in the area where you are looking to purchase a home.

Requirements:

First Time Home Buyer

Has not owned a home for last three years

Income Eligible

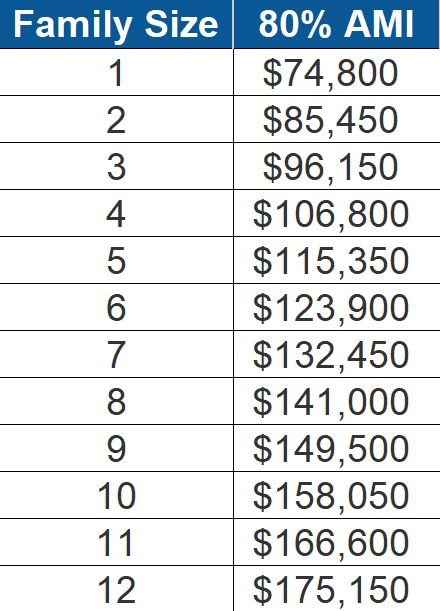

Household income up to 80% AMI (see graph for NYC)

Primary Residence

Keep home as primary residence for 15 years (starts off as a interest free loan and after 5 years the amount gets reduced by 10% every year)

Maximum Purchase Price

Complete a homebuyer education course

This needs to be done before purchasing the home.

More details here.

Value: Up to $100k

Ease of use: Complex ***

SONYMA – Home Purchase Assistance in New York State

RemodelNY – Include remodeling costs in a low-interest mortgage above.

Neighborhood Revitalization – up to $20,000 grant for renovating a home in eligible areas. More details.

Ease of use: Complex ***

STAR Property Tax Rebate

Property tax credits for a homeowner’s primary residence. Available if you are earning less than 500k/annually. You can either get credit applied against property taxes or receive a refund check.

Section 8

The government pays a portion of your rent. You pay 30% of your income.

In NYC, there is a waiting list.

Ease of use: Complex ***

COVID – Emergency Rental Assistance (ERA)

Emergency Rental Assistance (ERA) helps pay up to 15 months of rent for those who have financial hardships due to the pandemic.

COVID – Mortgage Relief

If you are experiencing covid-related financial hardships, ask your bank for a 180-day forbearance. After six months, if you are still experiencing financial hardship, you can request an additional 180-day forbearance. The forbearance pushes off your payments but does not cancel them.

Ease of use: Moderate **

- COVID – Eviction Protection

- NY: No evictions for non-payment of rent due to covid-related hardships through the end of the covid emergency. On 05/04/2021, Governor Cuomo extended the Moratorium until 08/31/2021.

- Federal: No evictions for non-payment of rent due to covid-related hardships through December 31, 2020. Extended to March 31, 2021.

- Rent Assistance

- Up to $550 a month towards your rent for income-eligible people. We haven’t seen published income level eligibility, but it is likely quite low.

- Part of NYC’s Cash Assistance (aka Temporary Assistance in NY State or TANF nationwide) which helps income-eligible people for up to 60 months.

- In NYC, use HRA Access to apply first for Cash Assistance together with SNAP/Medicaid.

- Value: $550 a month

- Ease of use: Complex ***

- Rent Assistance – Eviction Help

- If you are at risk of being homeless, including due to eviction proceedings you may qualify for assistance up to the full cost of your rent.

- Value: Up to the full cost of your rent

- Ease of use: Complex ***

EXPIRED – COVID – Rent Relief- COVID Rent Relief Program covers a portion of the rent for income-eligible people who paid more than 30% of their income as rent during any of the months between April-July 2020.

Further Assistance

- Temporary Assistance (NYC: Cash Assistance)

- Cash Assistance provides extra funds needy low-income people.

- In NYC you can sign up for Cash Assistance at the same time as applying for SNAP and Medicaid etc.

- Ease of use: Complex ***

- One-Shot Deal – NYC

- Emergency assistance to those facing eviction/homelessness, a utility shutoff, and other unexpected financial situations.

- Use HRA Access to apply

- Ease of use: Complex ***

- Power Outage Reimbursement – for SNAP recipients

- Disability – SSI

- NYC Care

- COVID – NY Held Loan Relief

- COVID – Student Loan Relief (State and Fed)

- COVID – NY Bank Fees Relief

- COVID – Personal Insurance and Life Insurance Relief

Screening Tools

- New York State

- NY State put out a new screening tool to see what you’re eligible for. Here’s the full list of services that this tool goes through.

- New York City

- NYC also has a screening tool to help you out with links for NYC residents.

1 thought on “Beyond COVID – Financial Assistance – Extensive List of Programs”

Your site is amazing. Can you add me to your mailing list for any updates? Thanks for making a user friendly experience.