Self-employed and 1099 workers: Use our calculator to confirm your PPP eligibilty and amount. The calculator also tells you if you can get PPP a second time. More guidance available at our PPP Resource Center.

You will need your Schedule C from either 2019 or 2020. If you have both, you will be able to see which one will get you a higher PPP.

PPP CALCULATOR

(1099 / Self Employed)

Did you already get the first round of PPP?

CALCULATE MAXIMUM PPP

Enter your gross income from 2019 or 2020

(Schedule C ‐ Line 7)

Note: You now have a choice to use either line 7 or line 31 when calculating your PPP amount. The higher the amount, the higher the PPP 🙂

See this article to understand the benefits of using line 7 vs line 31.

25% REDUCTION CALCULATOR

To be eligible for a second round of PPP, you need to have had a 25% reduction between 2019 and 2020. This calculator will help you calculate your reduction.

When did you start your business or start doing any 1099 work?

25% REDUCTION CALCULATOR

Please choose how you want to calculate your 25% reduction

25% REDUCTION CALCULATOR

Enter your gross income below to confirm your 25% reduction

PPP AMOUNT

Which Schedule C Should I Use?

Annual Amount

Monthly Amount

Estimated PPP Amount

You already received the first round of PPP. Here is your eligibility amount for the second round of PPP.

Which Schedule C Should I Use?

Annual Amount

Monthly Amount

Estimated PPP Amount

Food & Accommodation BusinessFor the second round of PPP, businesses in the food and accommodation services (NAICS 72) are eligible for 3.5 months of payroll instead of 2.5 months (approximately 30% instead of 20%). Being that you are in the food or accommodation industry, your PPP amount above was changed to the higher amount.

Apply Here for a Successful PPP

Here are our recommended PPP banks for a successful PPP application.

We included bank-specific guidance to ensure that your application is successful.

Schedule C

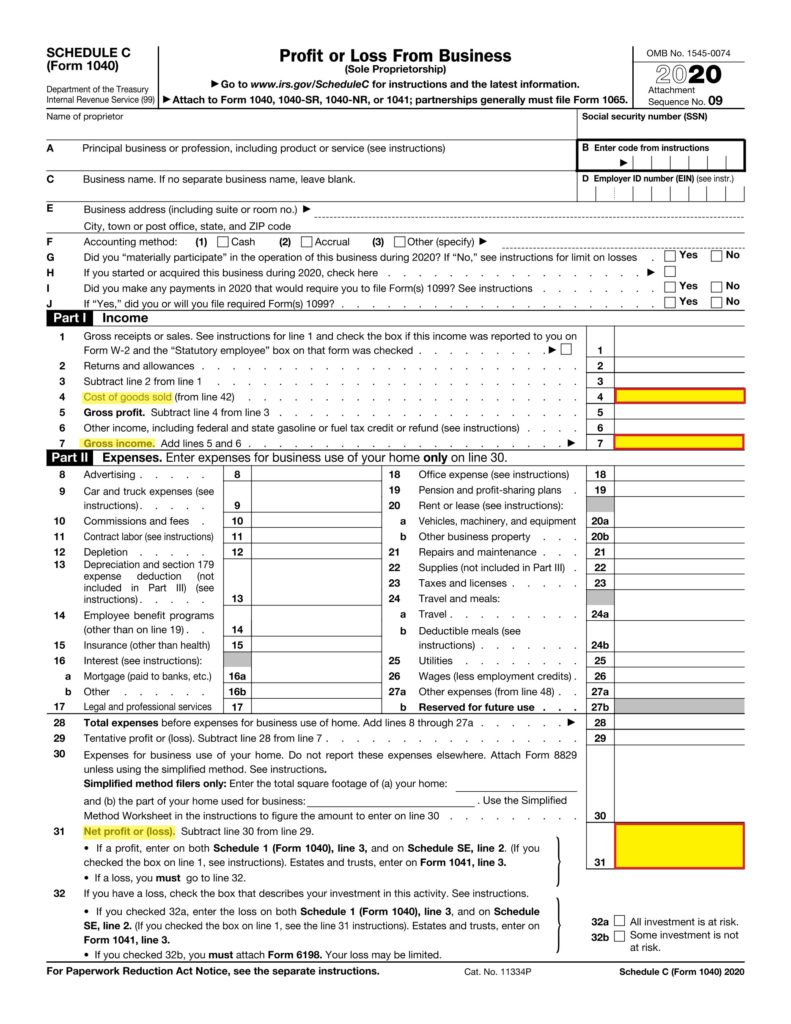

If you are self-employed or on a 1099, a Schedule C (see image below) should be in your personal tax return. If you didn’t file taxes yet, you can make (or ask your accountant for) a draft Schedule C.

“Gross” vs “Net” income

Gross Income: This is your income before any expenses, line 7 of your Schedule C.

Net Income: This is your profit after expenses, line 31 of your Schedule C.

As of 03/03/2021, you can calculate your PPP based on either gross income (line 7) or net income (line 31).

Wait time between First and Second Draw PPP

If you got your first round of PPP in 2021, check here to see if enough time has passed for you to apply for the second round of PPP. If you applied for the first round of PPP in 2020, enough time has definitely passed from your first round of PPP and you don’t need to check anything.

<In collaboration with ChaiPlus1>

This article was originally published on 01/25/2021. Last updated 04/28/2021