PPP (Paycheck Protection Program) is a completely free grant for self-employed and 1099 workers as well as for businesses with payroll.

Here are some key changes that put in place after the program originally launched in January 2021:

- 03/30/2021: PPP deadline extended until 05/31/2021 (instead of 03/31).

- 03/03/2021: Changes to PPP (03/03/2021). See below.

Self Employed & 1099 Workers Can Use Gross Income

Self-employed / 1099 workers can now use gross income instead of net income to calculate the PPP. This will help many people get more PPP.

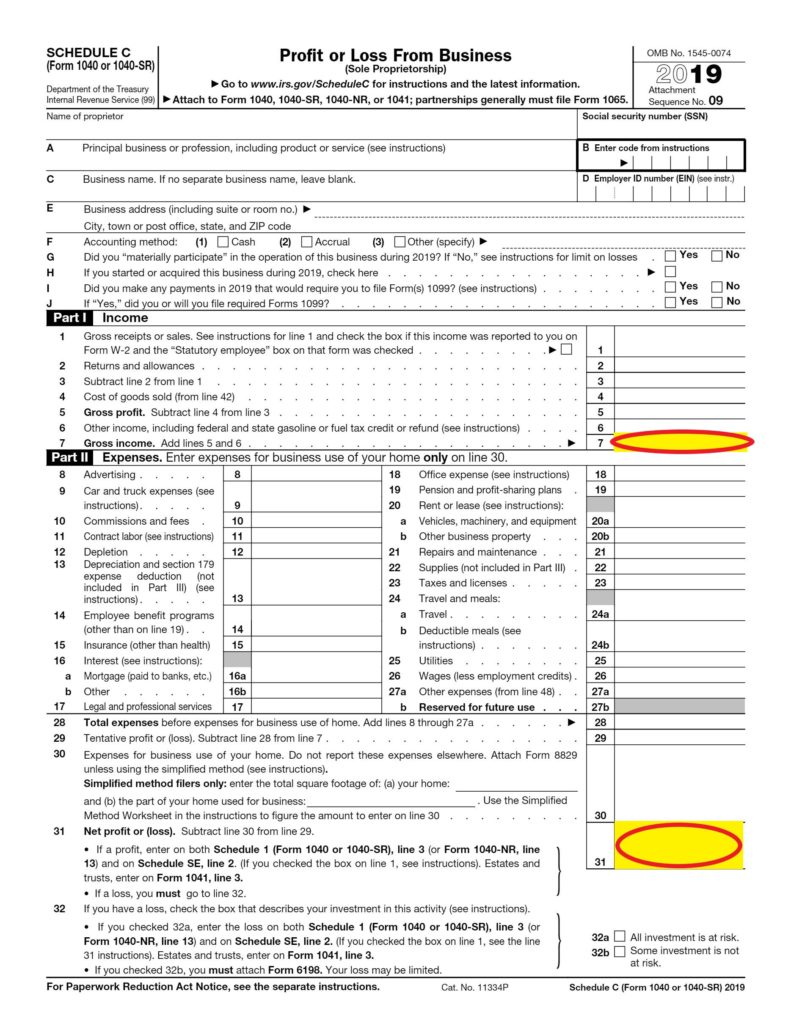

Self-employed and 1099 workers file a Schedule C as part of their tax return. Schedule C reports “Gross Income” (line 7) and “Net Income” (line 31). “Gross Income” is the amount you earned before expenses and “Net Income” is the amount you earned after expenses, basically, your profits.

Before this change, your PPP grant was approximately 20% of your net income (line 31). The new guidance allows you to get 20% of your gross income (line 7) instead. You are eligible even if your line 31 is negative – meaning you lost money.

Does this change affect me?

Have a look at your 2019 and 2020 Schedule C. (Didn’t file yet? Ask your accountant for a draft Schedule C.)

- If line 31 is over $100,000, you are already eligible for the maximum PPP of $20,833.33

- If you don’t report expenses on your Schedule C (meaning lines 7 and 31 are the same on both your 2019 and 2020 Schedule C), then this change does not affect you at all.

- If line 31 is less than $100k, and you report expenses (line 31 is less than line 7), you can get a larger PPP by using line 7 (gross) instead of line 31 (net).

I already applied before this change. Did I lose out?

- The new rules only apply to PPP applications that are approved after 03/03/2021 and not retroactively to those already funded. If retroactive changes become allowed, we will post an update.

- If you applied before 03/03/2021, but were not yet funded, you can ask your bank to withdraw your application from the SBA, and apply again.

See our PPP Resource Center for comprehensive PPP guidance.

Is there any benefit to using net income?

The new rules gives Schedule C filers a choice whether to base the PPP calculations on net income or gross income.

Even though gross (line 7) is always equal to or greater than the net (line 31), if your gross (line 7) is higher than $150,000, there is a benefit to going with your net income instead of gross.

Economic Necessity

The SBA said that all PPP applications under $2MM are automatically assumed to have “economic necessity”. Applications over $2MM don’t have that automatic “safe harbor”. The exception to this is using gross income to apply for PPP if gross income is over $150k, no matter how small the actual PPP amount is. When applying for PPP based on a Schedule C, if you choose to use your gross income to apply, AND you have over $150k in gross income, you won’t have the “safe harbor” of automatic “economic necessity”. The SBA will audit a portion of applications that applied for PPP based on gross income and have over $150k in line 7.

What you should do

- If your line 31 is over $100k, or if your net (line 31) is the same as your gross (line 7), then definitely go with net income.

- If your line 31 is less than $100k and your net (line 31) is less than your gross (line 7):

- If your line 7 is less than $150k, you should definitely go with gross income.

- If your line 7 is more than $150k, you should still consider going with gross income, but your “economic necessity” might be audited.

Note: The rule that Schedule C filers can use gross income instead of net income also applies to schedule C filers with employees.

Expanded Eligibility

The new guidance removes some disqualifications for self-employed individuals or 20%+ owners in businesses who have a prior conviction, student loan default/delinquency, or are non-citizens.

- A prior non-fraud felony conviction

- Previously, a business was ineligible for PPP if it is 20%+ owned by an individual who had either: (1) an arrest or conviction for a felony related to financial assistance fraud within the previous five years; or (2) any other felony within the previous year.

- The new guidance is that #2 won’t disqualify (unless the applicant is currently incarcerated).

- Delinquent on a federal student loan

- Previously, the PPP was not available to any business with 20%+ ownership by an individual who is currently delinquent or has defaulted within the last seven years on a federal debt, including a student loan.

- The new guidance removes the disqualification for delinquencies and defaults on student loans.

- Non-Citizen

- Previously, there was inconsistency for ITIN holders like Green Card holders or those in the USA on a visa

- The new guidance ensures that those who are non-citizens, yet are lawful US residents, can apply using an ITIN.

No Longer Relevant – Application Pause

For two weeks, 02/24 – 3/9, the SBA won’t accept new applications from businesses with 20+ employees.

External Links

- Interim Final Ruling from the SBA – 03/03/2021

- FAQ from the SBA – 03/03/2021

- Self-Employed Second Draw Application Form (2483) – 03/03/2021 (the bank will generally complete this form for you based on your application)

- Self-Employed First Draw Application Form (2483) – 03/03/2021 (the bank will generally complete this form for you based on your application)

2 thoughts on “Changes to PPP – Including Self Employed and 1099 PPP Now Based on Gross Income”

hi ! still not seeing updates for online places like blue vine or lendio. are y’all ?

separately, still not seeing IF OCR, owner compensation replacement would apply for gross income (vs net income on old forms)

separately, still not seeing anything on 10 weeks vs 24 weeks covered period with returning to pua.

( i am sole proprietor).

great site btw !!!!

I am an Independent contractor thank you for valuable advice!