This guide is for partnership businesses that have partners with income reported on line 14a of their K-1 1065. For other scenarios and everything you need to know about the PPP, visit our PPP Resource Center.

The Paycheck Protection Program (PPP) offers a free grant of 2.5 months of payroll to businesses in operation as of February 15, 2020. PPP starts out as a loan, then after 8+ weeks you can apply for forgiveness and that turns the loan into a free grant!

See more partner banks here.

< Written in collaboration with ChaiPlus1>

Step 1 – Locate Your Reports

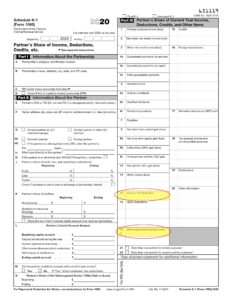

K1 – 1065

You need to submit a K-1 1065 for all partners who receive self-employment pay on line 14a to get PPP. If you didn’t file taxes yet for 2020 and want to use your 2020 numbers, you can make a draft K-1 1065 for PPP.

The K-1 1065 is a tax form that is generated for each partner as part of Form 1065 (partnership business tax return).

All partners must file a single PPP application all together under the business name and EIN. Partners cannot each file separate PPP applications.

Note that only partners residing in the USA are eligible for PPP.

Other Documents

Separately, banks also require documentation to prove certain PPP requirements. Below is a basic list.

- Business Organizational Documents

- 2019 business tax return (for loans over $150k)

- February bank statement proving that business was in operation by February 15, 2020 (an eligibility requirement)

- Photo ID for all 20%+ owners

Step 2 – How Much Will You Get?

K-1 1065 reports each partner’s self-employment income on line 14a, and that is what counts for PPP purposes. Step 1 is to look if for partners with numbers in line 14a as those are the only ones that will count for the PPP.

- Calculating each partner’s PPP: Take line 14a, minus line 12, then multiply by 92.35%. If this amount is more than $100k then use $100k, divide it by 12, and multiply by 2.5.

- Calculating the total of all the partner’s PPP: Do the above for each of the partners and add it all together. That is your total PPP.

You can use the K-1 1065 from either 2019 or 2020. Use whichever one is higher – you will get a larger PPP. Note that you must use the same year for all partners.

If the partnership also employs W2 employees, see our Step-by-Step Guide for Businesses with Payroll to compute what else you can include in your PPP application, on top of the partner compensation discussed in this post.

(Note: If you have unreimbursed partnership expenses, and oil and gas properties depletion (often not applicable), that needs to be deducted from line 14a as well.)

Step 3 – Two Rounds of PPP

There are two rounds of PPP, aka First Draw and Second Draw. If you get both, you get double the amount.

If you already got First Draw PPP, apply for Second Draw. If you didn’t yet get any PPP, then first get First Draw, and you may very well be eligible for Second Draw as well.

Step 4 – First Draw

Apply Today! Here are our recommended partner banks, along with helpful application tips.

Step 5 – Second Draw

Apply Today! Here are our recommended partner banks, along with helpful application tips.

There are two additional conditions that apply to Second Draw:

1) Correctly Used First Draw PPP

If you already received the First Draw, you must have used all your funds from that loan correctly and expect to receive 100% forgiveness, to be eligible for a Second Draw loan. See Step 6 for more information. You don’t need to have to actually apply for First Draw forgiveness before applying for Second Draw PPP.

2) Had a 25% Reduction

In order to be eligible for Second Draw, you need to have a 25% loss in gross receipts in at least one quarter of 2020 compared to the same quarter in 2019. For example, if your gross receipts in the second quarter of 2019 (April-June) was $10,000 and in the second quarter of 2020 your gross income was $7,000, that means you had a 30% reduction, thus making you eligible.

If your annual 2020 gross receipts is at least 25% less than your 2019 gross receipts, you are automatically eligible, because an annual 25% reduction automatically means at least one quarter with a 25% reduction. You can see your “gross receipts” on form 1065 (add lines 2 and 8 and deduct line 6).

For the reduction calculation, use your usual accounting method (cash vs accrual). Your business tax return will indicate what your usual accounting method is. Make sure that you calculate this using all sales/receipts.

Proof of 25% Reduction

If your PPP is over $150k, you need to provide proof of the 25% reduction when applying for Second Draw PPP. If your loan is less than $150,000 you do not need to provide proof of the 25% reduction when applying for the PPP. You will need to provide proof when you complete the forgiveness form 8+ weeks after you receive the PPP.

Acceptable Proof

- Annual Reduction

- Your form 1065 can be used as proof. If using a draft tax return to show the 25% reduction, you need to sign the return attesting that the gross receipts in the draft return will match the return that you will actually file with the IRS.

- Quarterly Reduction

- Financial statement. If not audited, then sign the front page and initial every page.

- Quarterly or monthly bank statements.

Step 6 – Forgiveness

PPP starts out as a 1% interest loan and then once you use the funds correctly, you can apply for forgiveness, thereby turning the loan into a grant (free money)!

You must apply for forgiveness within 10 months of using your funds, and if forgiven no interest will be owed.

You need to use the funds within the “covered period”. Your covered period starts when you receive funding, and continues for a period between 8 and 24 weeks. You can choose how many weeks you need in excess of 8 weeks, but not more than 24 weeks.

How To Use The Funds?

You can either spend 100% of the funds to pay partners or spend at least 60% of loan proceeds to pay partners and at the most 40% towards other expenses. Other expenses include:

Eligible Expenses

- Rent or lease (e.g. warehouse, office – including home office, storefront, vehicle, and equipment)

- Agreement in place before February 15, 2020

- Mortgage interest (real property and personal property)

- Signed agreement before February 15, 2020

- Utilities (E.g. Electricity, gas, phone, internet, water, and transportation)

- Service began before February 15, 2020

- Operation (Computer/cloud software that helps the business function)

- Property damage (vandalism or looting due to 2020 public disturbances)

- Supplier costs (owed to a supplier of goods)

- For orders in effect prior to taking out the loan, or perishable items, during the covered period.

- Worker protection expenditures (expenses to help comply with Covid regulations)

Apply For Forgiveness

After completing your covered period and using all your funds correctly, apply for forgiveness with your bank.

Scenarios

Food and Accommodation

- The SBA is making certain allowances for hard-hit businesses in certain industries. If your business’ NAICS code (found on your tax return) starts with 72, the following apply to you:

- First Draw: You can have up to 500 employees per location.

- Second Draw: You can have up to 300 employees per location.

- Second Draw: Multiply your average monthly payroll by 3.5, instead of 2.5. This will effectively give you an additional month of payroll funds.

What if I did not include all partners in my First Draw loan?

- Partnerships that accidentally submitted a First Draw application with only one partner’s information, can now request an increase from their original lender to include all partners. Note that all funds from First Draw loans must be used before applying for a Second Draw loan.

Second draw with more profits in 2020

- You can be eligible for the Second Draw even if your net business income in 2020 is higher than it was in 2019.

- How? The 25% reduction is only required in one quarter (every three months is a quarter) of 2020. The other three quarters in 2020 can have a substantially higher income than 2019 and you would still be eligible. You will still need to certify that current economic uncertainty makes the loan necessary.

Didn’t file your 2020 taxes

- Since businesses have not yet filed their 2020 taxes, acceptable proof to show the 25% reduction for Second Draw loans includes bank statements and financial reports.

You own multiple companies, or own a company and have a Schedule C for which you are also applying for PPP.

- Owners may not receive more than $20,833 in owner compensation paid via PPP funds, across all entities. We still recommend getting a PPP loan for each entity, because you can a) spend the amount on your employees or other allowable expenses or b) spend proportionally in each entity based on the 60/40 forgiveness rules (coming soon).

Seasonal business

- A “seasonal business” is open for less than 7 months in the year, or is open more than 7 months and earns in 6 consecutive months more than 3 times the other half of the year. A seasonal business must have been open for at least 12 weeks between February 15, 2019 and February 15, 2020.

- Calculate the average total monthly payroll for any 12-week period between February 15, 2019 and February 15, 2020 as per Step 2 above, and multiply by 2.5. Calculating this way can be very valuable to those who only operate for part of the year.

- If you are a seasonal business and did not use the above calculation for your First Draw loan, you can request an increase based on the above calculation from your originating bank. This option is only available if you did not yet file for forgiveness.

You started your partnership late in 2019 or early 2020

- First Draw: If you were not operational between 02/15/2019, and 06/30/2019, you can compute your First Draw loan using January and February 2020. Complete 2020 draft K-1 1065s for each partner for those two months only (be sure to cap line 14a at $16,667, to comply with the $100k/annualized cap), divide the amount by 2, and multiply by 2.5.

- Second Draw: If you started operations between 02/16/2019 and 02/15/2020, sum all partner’s K1 1065 line 14a for 2019 and 2020, compute how many months you are in operation, divide by number of months, and then multiply by 2.5. You must ensure that compensation does not exceed $8,333 on a monthly basis per partner.

How to calculate 25% reduction for new businesses

- If the entity was not in operation in Q1 or Q2 of 2019, but was in operation in Q3 and Q4 of 2019, the entity must calculate the 25% reduction in gross receipts by comparing Q1, Q2, Q3, or Q4 2020 to Q3 or Q4 2019.

- If the entity was only in operation Q4 of 2019 (and not Q1, Q2, and Q3), the entity must calculate the 25% reduction in gross receipts by comparing Q1, Q2, Q3, or Q4 2020 to Q4 2019.

- If the entity was not in operation in 2019, but was in operation as of February 15, 2020, the entity must calculate the 25% reduction in gross receipts by comparing Q2, Q3, or Q4 2020 to Q1 2020.

3 thoughts on “PPP Guide for Partnerships (K-1 1065)”

why not ln 14c gross nonfarm income as is same as schedule c gross income

Hi Mr. Ed,

My wife and I formed LLC in 2017 and we want to file PPP for 2.5 months income.

My wife owned 90% and I owned 10%.

Is any way you can help us apply to get a PPP loan.

regards,

Lenny

What number do you show on line 14A of each of your K1s?