The Paycheck Protection Program (PPP) offers a free grant of 2.5 months of payroll. It starts out as a loan, then after you apply for forgiveness, it turns into a free grant. Here is a step-by-step guide to help you prepare your PPP application.

Ready to apply? See our recommended places to apply for PPP Need help? Send an email, WhatsApp, or book a free five-minute consultation.

Written in collaboration with ChaiPlus1.

Step 1 – Locate Reports

You need to submit supporting documentation to get PPP. Most of the reports needed are easily available via your payroll provider.

1) Gross Wages

- Use payroll reports to calculate gross wages for all employees.

- Make sure to calculate using gross wages and cap all employees at $100,000 annually.

- You must deduct any wages reimbursed via FFCRA tax credits.

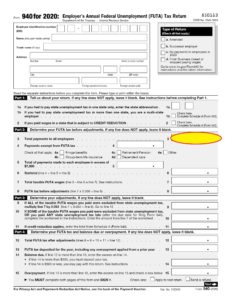

- Bank proof: Annual 940 report line 3 or Quarterly 941 reports, based on line 5c, column 1 (this amount is not capped at $100k per employee- it is your responsibility to do so).

2) State and Local Taxes

- This includes items such as SUI/SUTA tax paid by the employer. Employee paid taxes are not eligible, and not included on these reports.

- Bank proof: State reports. (NY: Quarterly NYS-45. NJ: Quarterly WR30 or NJ-927).

3) Employer-Paid Healthcare Expenses

- If your business does not offer employee healthcare, or if your business offers this but does not contribute, skip this step.

- Healthcare expenses include medical, life, disability, vision, or dental.

- Bank proof: Either IRS Form 990 (Part IX line 9) or a statement from your healthcare provider with amounts paid.

4) Employer-Paid Retirement Contributions

- If your business does not contribute to employee retirement funds, skip this step.

- Bank proof: Either IRS Form 990 (Part IX line 8) or a statement from your provider with amounts paid.

5) Owner Compensation

Each entity type has slightly different rules when it comes to what could be included for owner compensation (owners are defined as owning a 20%+ share in the business):

- C Corporations and S Corporations – 1120 and 1120S: If an owner is on payroll, simply follow steps 1-4 as for any other employee. If owner compensation is via 1099/Schedule C, then the owner needs to file a separate PPP for the Schedule C. Owner compensation via K1 (S Corp) owner distributions, is not eligible for PPP.

- Partnerships – K1-1065: Refer to the PPP Partnership Guide for what amounts can be included in your loan to account for owner compensation (Line 14a of K1 1065). This amount (maxed at $100k per partner) is in addition to all the calculations from payroll.

- Sole Proprietorships – Schedule C: Refer to the sole proprietorship guide – add your Schedule C line 31 (net income) or line 7 (gross income) minus lines 14, 19, and 26 (employee payroll costs). This amount (maxed at $100k) is in addition to all the calculations from payroll.

6) Other Documents

Separately, banks might require certain documentation. Below is a basic list:

- Articles of Incorporation or Business Organizational Documents

- 2019 business tax return

- 941 Q1 2020 or February 2020 bank statement (or invoice) proving that business was in operation as of 02/15/2020

- Photo ID for all 20%+ owners

- Voided check

Step 2 – How Much Will You Get?

<<< Calculate your PPP using our Exclusive Easy Eligibility Calculator >>>

Add up items 1-5 of the previous section. You will get approximately 20% of that. The exact amount is: items 1-5 ÷ 12, then × 2.5.

Businesses can calculate items 1-5 using either 2019 or 2020. Use whichever figures are higher, for a larger PPP 🙂

Food and Accommodation: If your business involves the food/accommodation industry, check if one of the “72” codes is applicable to you. If yes, for Second Draw you get approximately 30% of your lines 1-5 above (instead of 20%). Exact amount: Lines 1-5 ÷ 12 × 3.5

Notes

- First Draw loans are capped at $10 million, and Second Draw loans are capped at $2 million.

- For Second Draw loans, C Corps and S Corps can also elect to use the past 12 months instead of 2019 or 2020.

- Second Draw PPP can be based on 2020 payroll even if part of that payroll was paid for via First Draw PPP.

Step 3 – Two Rounds of PPP

There are two rounds of PPP, aka First Draw and Second Draw. If you get both, you get double the amount.

If you already got First Draw PPP, apply for Second Draw. If you didn’t yet get any PPP, then first get First Draw, and you may very well be eligible for Second Draw as well.

Step 4 – Apply Now – First Draw

Apply Now – See our recommended partner banks!

You must have less than 500 employees for First Draw

Businesses with more than 500 employees can still be eligible:

- Alternative Size Standard: Any business has less than $15 million in tangible assets and less than $5 million in net income on average over the past two years.

- Based on Primary Industry: Certain businesses are eligible even if they don’t meet the “Alternative Size Standard” condition. Depending on the industry, some are eligible up to a certain employee count and others are eligible based on total annual sales. You can check the industry based on the business’ NAICS code.

We offer assistance to businesses interested in exploring their eligibility. Feel free to reach out for more details.

Step 5 – Apply Now – Second Draw

You must have less than 300 employees for Second Draw

Apply Now – See our recommended partner banks!

There are two additional conditions that apply to Second Draw:

1) Used all First Draw PPP Correctly

If you already received the First Draw, you must have used all your funds from that loan correctly and expect to receive 100% forgiveness, to be eligible for a Second Draw loan.

Even if you manage to use all First Draw funds quickly, you still ensure that 8 weeks have passed between receving First Draw funds and receiving Second Draw gunds. Otherwise, you may have an issue with forgiveness of the Second Draw. See more here.

2) 25% Reduction

In order to be eligible for Second Draw, you need to have a 25% loss in gross receipts in at least one quarter of 2020 compared to the same quarter in 2019. For example, if your gross receipts in the second quarter of 2019 (April-June) was $10,000 and in the second quarter of 2020 your gross receipts was $7,000, that means you had a 30% reduction, thus making you eligible.

If your annual 2020 gross income is at least 25% less than your 2019 gross receipts, you are automatically eligible, because an annual 25% reduction automatically means at least one quarter with a 25% reduction.

For the 25% reduction calculation, use your usual accounting method (cash vs accrual). Your business tax return will indicate what your usual accounting method is. Make sure that you calculate this using all sales/receipts.

For a complete list of what to include in gross receipts, see our detailed PPP post.

Proof of 25% reduction

If your Second Draw PPP is over $150k, you need to provide proof of the 25% reduction at the time you apply for Second Draw PPP. If your loan is less than $150,000 you do not need to provide proof of the 25% reduction when applying for the PPP. You will need to provide proof when you complete the forgiveness form 8+ weeks after you receive the PPP.

Acceptable Proof

- Annual Reduction

- 2020 tax return (if you had an annual 25% reduction). If using a draft tax return to show 25% reduction, you need to sign the return attesting that the gross receipts in the draft return will match the return that you will actually file.

- Where to find your “gross receipts” on your tax return:

- Schedule C: lines 4 and 7

- Partnerships (Form 1065): lines 2 and 8, minus line 6

- S-Corporations (Form 1120-S): lines 2 and 6, minus line 4

- C-Corporations (Form 1120): lines 2 and 11, minus lines 8 and 9

- Nonprofit organizations (Form 990): lines 6b(i), 6b(ii), 7b(i), 7b(ii), 8b, 9b, 10b, and 12 (column (A)) of Part VIII

- Nonprofit organizations (IRS Form 990-EZ): lines 5b, 6c, 7b, and 9 of Part I.

- Quarterly Reduction

- Financial statement. If not audited, then sign the front page and initial every page

- Quarterly or monthly bank statements

Step 6 – Forgiveness

The PPP starts out as a 1% interest loan and then once you use the funds correctly, you can apply for forgiveness, thereby turning the loan into a grant (free money)! You must apply for forgiveness within 10 months of using your funds, and if forgiven no interest will be owed.

You need to use the funds within the “covered period”.

Your covered period starts when you receive funding, and continues for a period between 8 and 24 weeks. You can choose how many weeks you need in excess of 8 weeks, but not more than 24 weeks. Remember, the shorter this period, the more wages you can potentially use for the ERC credit.

How To Use The Funds?

You can spend 100% of the funds towards payroll costs (wages, state taxes, health benefits, retirement contributions and other employee benefits, all as defined above). You can also choose to spend at the most 40% towards other eligible expenses.

Eligible Expenses

- Rent or lease (e.g. warehouse, office – including home office, storefront, vehicle, and equipment)

- Agreement in place before February 15, 2020

- Mortgage interest (real property and personal property)

- Signed agreement before February 15, 2020

- Utilities (E.g. Electricity, gas, phone, internet, water, and transportation)

- Service began before February 15, 2020

- Operation (Computer/cloud software that helps the business function)

- Property damage (vandalism or looting due to 2020 public disturbances)

- Supplier costs (owed to a supplier of goods)

- For orders in effect prior to taking out the loan, or perishable items, during the covered period.

- Worker protection expenditures (expenses to help comply with Covid regulations)

Note: For loans over $50,000: do not reduce salary for employees earning less than $100k/annualized by more than 25%, and do not reduce FTE count.

Apply For Forgiveness

After completing your covered period and using all your funds correctly, apply for forgiveness with your bank.

Scenarios

Second Draw with more profits in 2020

You can be eligible for the Second Draw even if your net business income in 2020 is higher than it was in 2019.

How? The 25% reduction is only required in one quarter (every three months is a quarter) of 2020. The other three quarters in 2020 can have a substantially higher income than 2019 and you would still be eligible. You will still need to certify that current economic uncertainty makes the loan necessary.

Didn’t file your 2020 taxes

Since businesses have not yet filed their 2020 taxes, acceptable proof to show the 25% reduction for Second Draw loans includes bank statements and financial reports.

Own more than one company

This applies to you if you own multiple companies, or own a company and have a Schedule C for which you are also applying for PPP.

Owners may not receive more than $20,833 in owner compensation paid via PPP funds, across all entities. We still recommend getting a PPP loan for each entity, because you can a) spend the amount on your employees or other allowable expenses or b) spend proportionally in each entity based on the 60/40 forgiveness rules (coming soon).

Food and Accommodation

The SBA is making certain allowances for hard-hit businesses in certain industries (primarily food and accommodation). If your business’ NAICS code (found on your tax return) starts with 72, the following apply to you:

- First Draw: You can have up to 500 employees per location.

- Second Draw: You can have up to 300 employees per location.

- Second Draw: Multiply your average monthly payroll by 3.5, instead of 2.5. This will effectively give you an additional month of payroll funds.

Seasonal Business

A “seasonal business” is open for less than 7 months in the year, or is open more than 7 months and earns in 6 consecutive months more than 3 times the other half of the year. A seasonal business must have been open for at least 12 weeks between February 15, 2019 and February 15, 2020.

Calculate the average total monthly payroll for any 12-week period between February 15, 2019 and February 15, 2020, using items 1-5 listed above , and multiply by 2.5. Calculating this way can be very valuable to those who only operate for part of the year.

How to calculate 25% reduction for new businesses

- If the entity was not in operation in Q1 or Q2 of 2019, but was in operation in Q3 and Q4 of 2019, the entity must calculate the 25% reduction in gross receipts by comparing Q1, Q2, Q3, or Q4 2020 to Q3 or Q4 2019.

- If the entity was only in operation Q4 of 2019 (and not Q1, Q2, and Q3), the entity must calculate the 25% reduction in gross receipts by comparing Q1, Q2, Q3, or Q4 2020 to Q4 2019.

- If the entity was not in operation in 2019, but was in operation as of February 15, 2020, the entity must calculate the 25% reduction in gross receipts by comparing Q2, Q3, or Q4 2020 to Q1 2020.

Businesses that started after February 15

Entities not in operation as of February 15, 2020 are not eligible. To establish operation one must have proof such as bank statements, invoices, financial statements, etc.

Businesses that were not in operation for the entire 2019

- First Draw: If your business was not in operations from 02/15/2019-06/30/2019, you have the option to calculate your average monthly payroll by adding Jan and Feb 2020 payroll and dividing by 2 (then x 2.5 for your PPP)

- Second Draw: If your business is a C Corp or an S Corp, and the business started operations between 02/15/2019 and 02/15/2020, you have the option to sum all payroll available from when business starter operations until loan date, then calculate the monthly average payroll (divide by the number of months) x 2.5.

Employees out of the United States

All employees and owners that you include in your calculation must reside in the United States. So if you have some employees that live out of the USA, although they will count towards your maximum business size, they are not eligible for the PPP.

PPP vs FFCRA vs ERC

You can claim ERC credits if you claimed or will claim PPP forgiveness, but you cannot claim the credits for the same period as the wages covered by your PPP forgiveness. This is to prevent a double benefit of receiving wage credits for the same wages twice.

Due to the legal language pertaining to this section, it is best to first file for PPP forgiveness, and once approved, file for ERC.

You can claim FFCRA credits if you received a PPP loan, but you cannot claim the credits for the same wages that you claimed forgiveness for in your PPP loan. This is to prevent a double benefit of receiving forgiveness on wages paid for paid leave, and then seeking a tax credit against the same wages.

Sample Form