Here is a step-by-step tutorial on how to apply for PPP with our banking partner, Biz2Credit. This application tutorial is for First Draw PPP for Partnerships. “First Draw” means that you did not get PPP previously. If you already received the first round of PPP funding, you need to apply for Second Draw.

Before applying, it is best to first read the PPP Guide for Partnerships in order to get a better understanding of PPP eligibility for Partnerships. For other business types, visit our PPP Resource Center.

If your partnership also has employees on Payroll, use our Businesses with Payroll Tutorial.

<Written in collaboration with ChaiPlus1>

Step 1 – Find Your K-1 1065

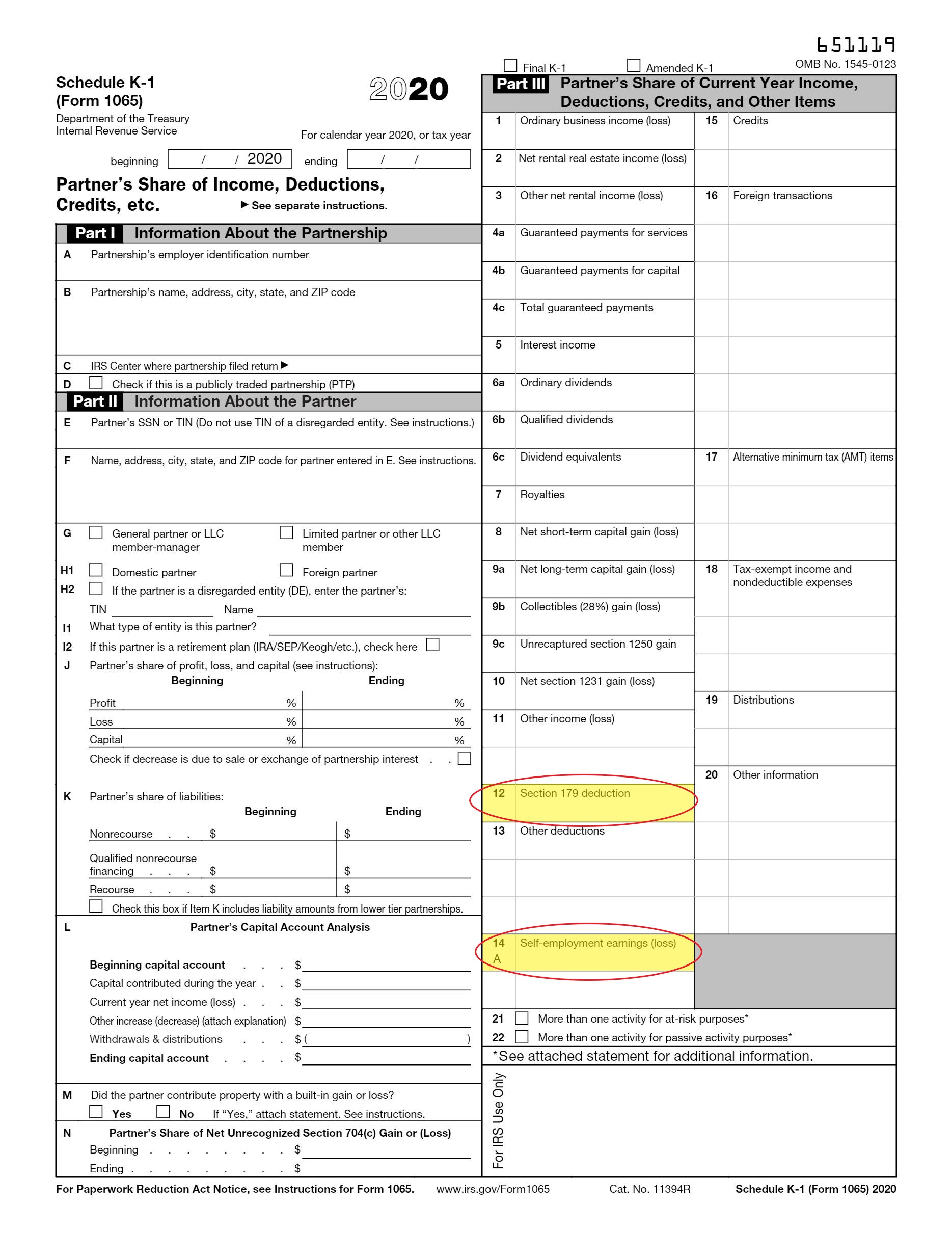

As part of your application, you will need to reference your K1-1065 (one for each partner). There should be one K1-1065 for each partner in your Partnership K1 tax return

Here is a sample K-1 1065. We highlighted all the parts that you will need to complete your PPP application.

Step 2 – Apply!

Start your application with our banking partner, Biz2Credit.

When you apply using our dedicated link, we will be in a position to help you along the way if you get stuck with your application for whatever reason.

This is the landing page. Click the button ‘Get started now’.

‘Continue to PPP Application’

Since this is your First Draw application, select “No PPP Loan”.

- If you already read the guide and know your Average monthly payroll, you can “Skip Ahead” (and skip the next two screenshots) and enter your Average monthly payroll manually.

- You can also click ‘Check Eligibility’ to confirm your eligibility and get some help calculating your monthly payroll.

Your answers most likely look like the above.

Details

- In order to be eligible for a PPP, you must have been in operation as of February 15, 2020. If the answer here is “no”, you are not eligible.

- If your business was not in operation for the full year 2019, read the guide.

- Select “no” if you are in operation for more than 7 months of each year, or if you earn mostly the same amount throughout the year. (If you are a “seasonal business” your average monthly payroll should be calculated using a 12-week period you choose between February 15, 2019 and February 15, 2020.)

- If you’re applying for multiple partners, the answer is “yes” (even though technically speaking, partners are not employees). If you are only applying for one partner (the rest don’t have anything in line 14a), the application will skip the next two screens. If the partnership employs actual employees, use our businesses with payroll tutorial instead.

- The answer is most likely “no”.

- A publicly-traded company is one whose shares are listed on a nationally registered exchange. Public companies are generally ineligible for PPP loans. The answer here is most likely “no”

- Skip this question if it doesn’t pertain to you.

- From the drop-down, select “2019 Full Year” if using 2019 K1 1065s, and “2020 Full Year” if using 2020 K1 1065s (as a partnership you do not have the ability to use “Last 12 months” – this option is only available to C and S Corps).

- Look at each partner’s K1 1065 and add line 14a for all partners. Note that not all partners will necessarily have an amount on this line.

- Per SBA guidance, reduce line 14a by line 12, (section 179 expense deduction- often not applicable), then multiply by 92.35%, then cap each partner at $100k.

- You can not add additional benefits for partnerships without employees.

- You can not add state taxes for partnerships without employees.

- Enter the number of partners that you’re including with amounts on line 14a of their K1 1065. Partnerships with more than 500 partners are not eligible for PPP.

- If you have partners out of the USA, this helps you deduct their compensation (partners out of the USA are not eligible for PPP)

- 1099 workers are not considered employees and any payments made to them are not considered payroll (though they are eligible for their own PPP!)

- You need to deduct compensation in excess of $100k for any partner with line 14a exceeding $100k (PPP only considers compensation up to 100k a year). This calculator will only work if all partners earning over $100k are earning the same amount.

- From the drop-down, select “2019 Full Year” if using 2019 K1 1065s, “2020 Full Year” if using 2020 K1 1065s (as a partnership you do not have the ability to use “Last 12 months”). If you completed the “Loan Eligibility” section above, your “time period” will be prepopulated.

- If you started operations after June 30, 2019 you also have the option of choosing Jan and Feb of 2020, but note that while you can base your PPP on Jan and Feb of 2020, forgiveness will ultimately depend on your filed 2020 K1 1065.

- For “Average monthly payroll”, look at line 14a of all your K1 1065s- this might be blank for some partners. Add up all partner’s line 14a, divide that number by 12 (round up to the nearest whole dollar amount). If you completed the “Loan Eligibility” above, your Average Monthly Payroll will be prepopulated.

- Check the box that you don’t have more than 500 employees (partnerships with more than 500 partners are not eligible)

- No, you most likely don’t want to refinance an EIDL here. So click “no”.

- Unless your business is a farm or a ranch, you can leave the last question alone.

You’re eligible for PPP, great! This should equal roughly 20% of line 14a for all partner’s K1 1065 added together. If the amount is not right, go back and check your numbers.

- Complete the above with your business information.

- Your NAICS code is a 6 digit code located on line C of your business 1065 return

- Select “partnership”

- Check your Article of Organization

- Enter your EIN

- As a partnership you have an EIN, so don’t click this box

- The answer is most likely “no”

- As a partnership, do not check the box.

- Your own social security number (not your business EIN)

- Enter your ownership percentage

- “Add Owner” for any partner over 20%

- Purpose of Loan: Check the box ‘Payroll expenses’ and any other expenses you wish to use your funds for. (I don’t think it matters that much what you include in “Purpose of Loan”).

- Read the other questions – the ones chosen above are the most common answers.

If you answer yes to any of these questions, you are not eligible for PPP.

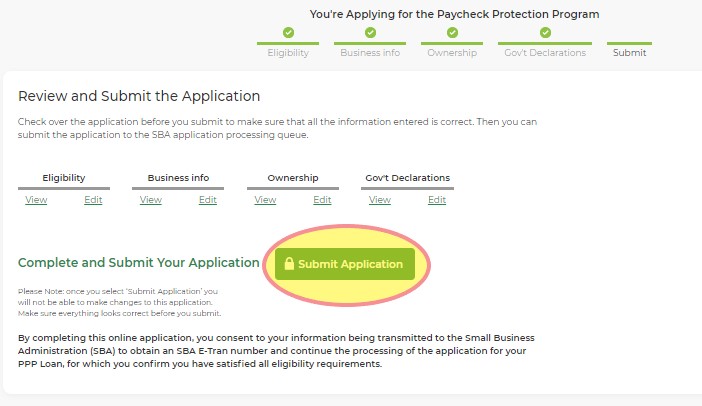

Submit Application 🙂

Now upload your required documents

- K1 1065 for each partner that you included in the PPP calculation (upload this where it asks for Form 940)

- Bank Statement from February 2020 (upload this where it asks for Form 941 – Q1 2020)

- For loans over $150k, 2019 business 1065 tax return

- Front and back of license (or passport) for all 20% plus owners

Voided Check

Also, upload a voided check (blank check with the word “VOID” written across the check) in order for them to have your account details where to send the funds. If you don’t have a blank check, then upload a letter from the bank with your account and routing number is shown. Look at your statement to see if one of the pages shows your routing and account numbers.

Voila! You are all set!

Step 3 – After You Apply

- Biz2Credit will check your application and then submit it to the SBA

- Due to added checks and manual reviews done by the SBA, this step can take some time – up to a few days.

- Once your application is approved by the SBA, you should receive a DocuSign to sign your PPP application.

- After submitting your signed application, Biz2Credit will review your application and once it’s finalized, you will receive a second DocuSign (from Itria Ventures – Biz2Credit’s bank) with your PPP offer.

- Within a few hours of accepting your offer, you’ll be funded!

- After 8+ weeks, apply for forgiveness!