Here is a step-by-step application tutorial on how to apply for a PPP with our banking partner, Biz2Credit, for Second Draw PPP for businesses with payroll. “Second Draw” means that you already received the first round of PPP and are now applying for the second round.

Additional PPP Guidance for Businesses with Payroll

- Guide for Businesses with Payroll

- Biz2Credit Application Tutorial – Round One

- For other business types, visit our PPP Resource Center.

<Written in collaboration with ChaiPlus1>

1) Calculate Payroll

First, calculate your payroll using our ‘PPP Guide for Businesses with Payroll’ for easy-to-follow instructions. The Biz2Credit application process also helps with some of these calculations.

2) Find Your First Draw PPP Information

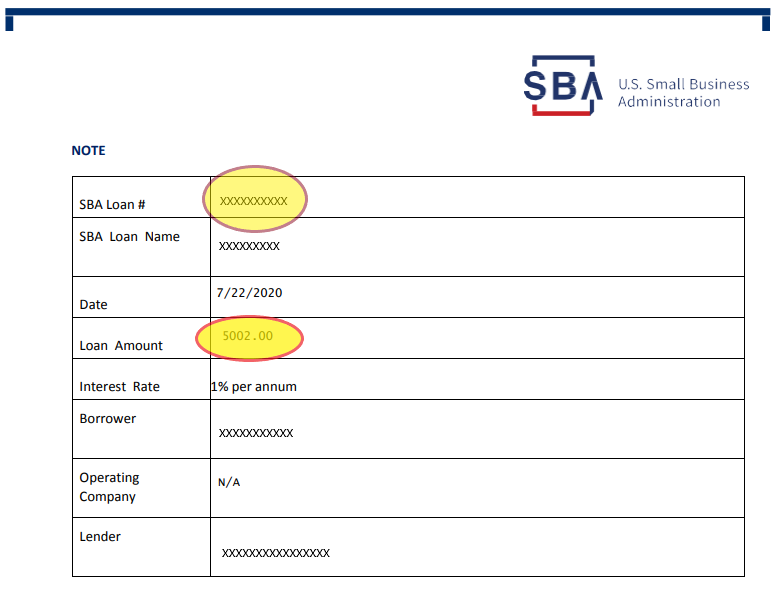

You need your SBA Loan Number from your First Draw PPP.

You can get this information from the bank that processed your First Draw PPP – you may have it as a Docusign in your email as well.

Here is a sample First Draw loan document with SBA Loan # and Amount.

3) Confirm 25% Reduction

Part of eligibility for Second Draw is a 25% reduction in gross receipts in at least one quarter of 2020 compared to the same quarter in 2019. Use our easy-to-use exclusive calculator to confirm your 25% reduction..

4) Apply!

Start your application with our banking partner, Biz2Credit.

When you apply using our dedicated link, we will be in a position to help you along the way if you get stuck with your application for whatever reason.

This is the landing page. ‘Get Started Now’.

‘Continue to PPP Application’

Since this is your Second Draw application, select “Already Had a PPP Loan”.

- You need your SBA Loan Number from your First Draw PPP.

- Once you enter the loan number, the loan amount should be automatically pre-filled.

- If you are affiliated with any other businesses, you are meant to include all their First Draw PPP loan numbers and amounts as well.

Click ‘Check Eligibility’ to confirm your eligibility and get some help calculating your monthly payroll.

Your answers most likely look like this. The “Special Conditions” only apply if you file a Schedule C – Sole Proprietorship.

Details:

- In order to be eligible for a PPP, you must have been in operation as of February 15, 2020. If the answer here is “no”, you are not eligible.

- If your business was not in operation for the full year 2019, read the guide.

- Select “yes” if you are in operation for less than 7 months of each year, or if you earn three times more in six months of the year than the other half of the year.

- Since you have Payroll, the answer is “yes”.

- If you are in the restaurant or accommodation business (and your NAICS starts with 72), you will get approximately 3.5 months of payroll instead of 2.5!

- The answer is most likely “no”.

- A publicly-traded company is one whose shares are listed on a nationally registered exchange. Public companies are generally ineligible for PPP loans. The answer here is most likely “no”

- Optional: If you are a Sole Proprietorship (you file tax form Schedule C), and wish to use Gross Income for owner compensation, click the first box. If you file a Schedule F, then click the second box.

Here is where you confirm that you had a 25% reduction from 2019 to 2020. If you had an annual 25% reduction from 2020 compared to 2019, then answer “Yes”. Otherwise, answer “No”.

If you answered “Yes” to annual reduction, enter your gross receipts from 2019 and 2020 to confirm that you had a 25% reduction.

If you answered “No” to annual reduction, enter your gross receipts from one quarter to confirm a 25% reduction in at least one quarter. Note: You only need a 25% reduction in gross receipts in one quarter to be eligible. If you have one quarter with a 25% reduction, you are eligible even if the other quarters you had more gross receipts than in 2019.

- From the drop-down, select “2019 Full Year” if using your 2019 payroll, “2020 Full Year” if using your 2020 payroll, or “Last 12 months”, if you’re using the past 12 months of payroll (this option is only available to C and S Corps).

- If you started operations after June 30, 2019 you also have the option of choosing Jan and Feb of 2020 (not helpful for most applicants)

- All Entity Types: Enter your gross payroll (see the guide and Exclusive Calculator for more info)

- Adding Owner Compensation:

- Partnerships (K1 1065): Add line 14a of each partner’s K1 1065 to your gross payroll. Per SBA guidance, reduce line 14a by line 12, then multiply by 92.35%, then cap at $100k per partner.

- Sole Proprietorship (Schedule C): If you elected to use net income, add line 31 (capped at $100k) to your gross payroll. If you elected to use gross income, this screen will look slightly different and will prompt you to add line 7 minus employee payroll costs – lines 14, 19, and 26 (capped at $100k).

- Adding Owner Compensation:

- If your total annual payroll costs do not include employer-paid benefits (retirement, health, and others), add them here.

- Only include employer-paid state Unemployment taxes. Don’t include any federal employer-paid taxes or any taxes that are withheld from employees. Do not add any state tax for partners or sole prop owners.

- Enter the number of employees as of 02/15/2020 (maximum 300)

- If you have employees out of the USA, this helps you deduct their salaries (employees out of the USA are not eligible for PPP)

- 1099 workers are not considered employees and any payments made to them are not considered payroll (though they are eligible for their own PPP!)

- You need to deduct any amount over $100k for a single person (PPP only considers salaries up to 100k a year). This calculator will only work if all your employees earning over $100k are earning the same amount

- This will be prepopulated based on the information you provided.

You’re eligible for PPP, great! This should equal 2.5 months of payroll (plus other eligible expenses) or 3.5 months of payroll for NAICS 72. If the amount is not right, go back and check your numbers.

- Complete the above with your business information.

- Your NAICS code is a 6 digit code located on your tax return.

- Choose your business structure

- If you file a Form 1120, select C Corp

- If you file a Form 1120s, select S Corp

- If you file a Form 1065, select Partnership

- If you file a Schedule C, select Sole Prop

- Check your business’s incorporation or articles of organization

- Enter your EIN

- If you run payroll, then you have an EIN, so don’t click this box

- The answer is most likely “no”

- If the business is owned by another business (and not by individuals), check the box.

- Your own social security number (Not your business EIN)

- Enter your ownership percentage

- “Add Owner” for any owner over 20%

- Purpose of Loan: Purpose of Loan: Check the box “Payroll expenses” and any other expenses you wish to use your funds for.

- Read the other questions – the ones chosen above are the most common answers.

If you answer yes to any of these questions, you are not eligible for PPP.

Now upload your required documents

- Form 940 (2019 or 2020)

- Form 941 Q1 2020

- Proof of any State taxes

- Proof of benefits (e.g. health, life, and retirement)

- Photo ID for any 20%+ owner

- For loans over $150k, 2019 tax return

- For loans over $150k, proof of 25% reduction (more on that here)

Voided Check

Also, upload a voided check (blank check with the word “VOID” written across the check) in order for them to have your account details where to send the funds. If you don’t have a blank check, then upload a letter from the bank with your account and routing number is shown. Look at your statement to see if one of the pages shows your routing and account numbers.

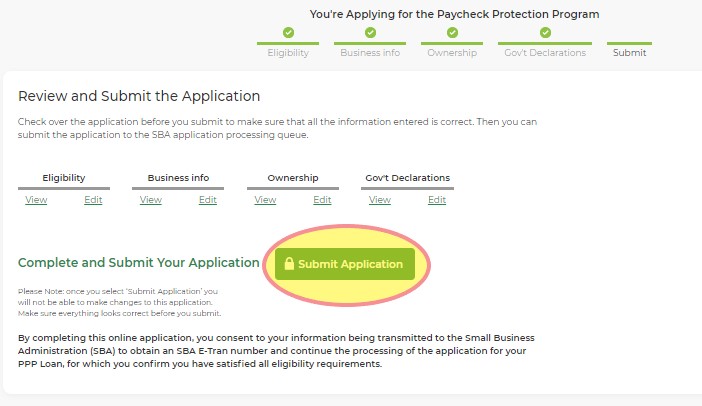

Voila! You are all set!

5) After You Apply

- Biz2Credit will check your application and then submit it to the SBA

- Due to added checks and manual reviews done by the SBA, this step can take some time – up to a few days.

- Once your application is approved by the SBA, you should receive a DocuSign to sign your PPP application.

- After submitting your signed application, Biz2Credit will review your application and once it’s finalized, you will receive a second DocuSign (from Itria Ventures – Biz2Credit’s bank) with your PPP offer.

- Within a few hours of accepting your offer, you’ll be funded!

- After 8+ weeks, apply for forgiveness!