Unemployment is a weekly payment made to people who are unemployed. Due to Covid, the government has expanded Unemployment to include almost anyone who is not working at all or not working as much as they would have liked to because of Covid.

*If you are not eligible for standard Unemployment or PUA, check if you are eligible for Excluded Worker Fund, a special program for those not eligible for the regular Unemployment.

Contents

- Am I Eligible to Apply for Unemployment?

- From When Am I Eligible to Start Collecting Unemployment?

- Am I eligible to Stay on Unemployment?

Can I Apply for Unemployment?

Four Scenarios in short

You were employed before and now are no longer working.

You were self-employed before and now are no longer working.

You didn’t work in the previous 18 months and are now also not working.

You are now working part-time (with regular employment or self-employment).

Anytime it says “now” above, it’s referring to your application date. So if you are applying with a backdated start date, “now” refers to that start date.

You can be eligible for the new-and-improved unemployment no matter which of the four employment possibilities relate to you, as long as you are now either not working at all or only working part-time (three or fewer days per week).

Four Scenarios Explained

You were employed before and now are not working.

You were working for an employer within the past 18 months, and you are now no longer working.

Was I ’employed’? An easy way to know is if you are considered to have been “employed” is if you were getting a W2 at the end of each year or if your employer withheld taxes from your paycheck, so your take-home check was less than your salary.

You were self-employed before and now are not working.

You were working for yourself (“Self-Employed”) and now can not work due to Covid-19.

What does Self-Employed mean? This means that you were working on your own, not for a company. If you were getting paid via a 1099 at the end of the year and/or if no tax is withheld from your paycheck, you are “self-employed”. If you are considered an “Independent contractor”, you are “self-employed”.

How much do I need to have earned to be considered “Self-Employed”? I have not seen a minimum amount of earnings required in order to be considered “self-employed”. As long as you were in business for yourself even if your business has not yet turned a profit. Something to note: The NY Department of Labor defines work when one is unemployed as: “…any service you performed for a business or person on any day in the week, even if it was only for an hour or less. This includes work you did in self-employment or on a free-lance basis, even if you were not paid.” (Source: Certifying weekly benefits, labor.ny.gov)

You never worked before (not even self-employed).

You never worked before and you were going to commence employment but couldn’t due to Covid-19.

The DOL looks at the 18 months prior to your effective application date, so if you haven’t worked in the past 18 months, it’s the same as if you never worked.

The CARES Act does not have prior work history as a requirement. Basically, even if you never worked before, as long as you were going to start working, just couldn’t due to Covid-19 then you should be eligible.

Here is the wording from NY as one of the eligible scenarios for PUA: “Scheduled to commence new employment but cannot reach the workplace as a direct result of COVID-19”. You may need to produce an offer letter from a potential employer. If someone was about to start a self-employed business that he then couldn’t launch due to Covid-19, may need to produce their business plan that was disrupted by Covid-19. It’s hard to say for sure how individual states will handle people in this situation, but the federal guidance is quite clear that you would be eligible if you were actually going to start work but could not due to the pandemic.

You are currently working part-time and can’t work as much as you would like to.

You can be “part-time” when working for a company or when self-employed.

You are eligible if you are:

Currently working 3 or fewer days per week (no difference how long per day!)

ANDEarning less than $504 a week (does not seem to apply to self-employed people).

ANDEither previously working more hours/pay, or you wanted to work more hours but cannot, due to an eligible Covid-related reason.

Definitely Eligible

-

Never worked before at all, but have a job offer that you were going to start, or self-employment opportunity that you were going to start, but now cannot because of Covid-19.

-

Self-employed and can’t work now, due to Covid-19.

-

Started a self-employed business but didn’t turn a profit yet and now cannot work due to Covid-19.

- Spouse currently earning or currently receiving unemployment. Unemployment is individual-based, not family-based. If you are unemployed, you are eligible, even if your spouse or another adult in your household is a high earner. Even if you were a dependent on someone else’s tax return, you may still be eligible for unemployment. Also, two spouses can both collect unemployment at the same time, as long as they are both eligible.

-

Lost your job more than a year ago and haven’t worked at all in the past year.

-

Your workplace closed due to Covid-19.

-

You are the primary caregiver for your children, who need your attention constantly and their place of childcare is closed. You were not laid off, your workplace is open and your boss wants you to work from home, even to work from home or telework.

-

You do freelance work for a company on a 1099 and can’t work, due to Covid-19.

-

Fired from your job because your boss thought you were not doing a good enough job. (If you were fired for misconduct, you might not be eligible.)

-

Don’t see your scenario? Check the FAQ and the BLOG for lots more scenarios!

Somewhat Eligible

-

You still work, but you are now working reduced hours. So as long as you are working less than 4 days per week and earning less than $504 a week, you are eligible. State unemployment is reduced by ¼ per day you work, so here’s how it works:

-

If you worked one day in a week, you lose 25% of your state benefit (still get the full $600).

-

If you worked 2 days, you lose 50% of your state benefit (still get the full $600).

-

If you worked 3 days, you lose 75% of your state benefit (still get the full $600).

-

If you worked 4 days (or more), you lose 100% of your state benefit, and most likely you also lose your $600 as well.

-

The above four scenarios is per week that you collect unemployment. If you are not eligible for one week, you can still be eligible the following weeks. I believe you need to be eligible during the week that you actually apply for unemployment.

Not Eligible

-

You are currently working and would like to leave employment in order to collect unemployment. You are not the primary caregiver and you are not medically required to quarantine.

-

If you are working 4 or more days per week and getting paid, (including if you are teleworking from home). You are only not eligible if you worked 4 days all along and are still working 4 days a week now. If there were some weeks that you worked only 3 days a week, you can still be eligible for those weeks.

-

If you are getting paid sick leave or paid family leave – again this is only an issue for those specific weeks that you are getting paid sick leave or paid family leave.

Not eligible for unemployment but eligible for other Covid-19 financial help

-

If you are working and are not eligible for unemployment, look into Paid Family Leave for Covid-19

-

If you are feeling too sick to work because of the virus, it seems that you are eligible for either unemployment or paid sick leave. Click here for Covid-19 paid sick leave.

-

If you are currently self-employed or running your own business, check this link for grant/loan information.

See more scenarios in the FAQ

Old Pre-Covid Rules

Note: These are the pre-Covid rules. Scroll down for the current Covid rules.

Payment Amount: Capped by each state. NY, for example, gives approx 50% of earned income, up to $504/week, up to 26 weeks. (Mississippi is all the way at the bottom with a maximum of $235 a week and Massachusetts at the top with a maximum of $823 per week, or more with dependents.)

Eligibility: You must have worked for an employer within the previous 18 months and were laid off. You also have to have a minimum amount of work history to be eligible. Though if you were laid off a year ago, you would still be eligible. Someone without a work history within the previous 18 months or a self-employed person would be ineligible. Also, if someone quit their job – even for good reason – they would not be eligible.

Timing: You generally only collect unemployment from the week after you apply. If you didn’t apply right when you lost your job, there is no back pay, unless you show good cause why you didn’t apply straight away.

Length of time: Limited to a certain amount of weeks. In NY, it’s 26 weeks.

Looking for work: While receiving unemployment insurance, you must “look for work” and provide proof that you are trying to find work.

However… the above limitations don’t apply during Covid-19!

New Covid Unemployment Rules

As part of the CARES Act, unemployment assistance has been drastically expanded to help everyday people who are financially impacted by Covid-19. Many of us have never claimed unemployment. Many of us also never lived through a pandemic. If you can’t work because of this virus, this is for you. The information below is based on NY. Click here to access the unemployment website for each state.

So what exactly has the government done to improve unemployment?

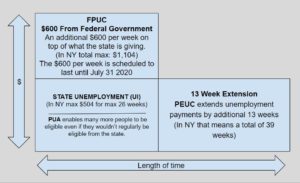

Payment amount. Until July 31, 2020, Federal Pandemic Unemployment Compensation (FPUC) adds $600 to what you would get from the state. This is automatically added to anyone getting state unemployment from their state. In NY, the “regular” max is $504/week, so the amount now jumps to $1,104 a week.

Eligibility: Pandemic Unemployment Assistance (PUA) greatly expanded who is eligible for unemployment. Many people who are not eligible for state unemployment now become eligible. For example, self-employed people or people without a work history.

Timing: The PUA also added a provision to backpay from the time of unemployment (if it is due to Covid-19) and also remove the waiting week requirement. So now, unemployment starts from the first week of unemployment and also gets back paid to the date that you could no longer work to the virus.

Length of Time: Pandemic Emergency Unemployment Compensation (PEUC) extends the time one can get unemployment payments by an additional 13 weeks. In NY, where the maximum is 26 weeks, one can now get unemployment payments for 39 weeks. The additional $600 per week stops July 31st.

Looking for work: Due to Covid-19, this requirement is flexible, so you may not be required to look for work in order to stay eligible each week. For further details, see ‘I heard I need to look for work while getting unemployment. Do I?‘

From When Can I Start Collecting Unemployment?

If you became eligible for Unemployment at some point in the past and are only applying now, you can have your Unemployment start date backdated.

In the CARES Act (03/27/2020) the rule was that a claim can be backdated to January 27th, 2020. This was changed in the Coronavirus Response and Relief Bill (12/27/2020), and now the earliest date to backdate a new claim is December 1, 2020.

Although getting backpay is officially only for PUA, reports are that backpay is being given for regular Unemployment as well.

Related Articles

EIDL Loan – Up to $2 Million

EIDL offers up to $2 Million low-interest loan to eligible businesses.

New York State Small Business Recovery Grant Program – Up to $50K

Covid-19 grant between $5k – $50k for eligible small businesses in New York State.

New York State Small Business Seed Funding – Up to $25k

NYS grant between $5k – $25k for eligible small businesses in New York State that started business after 9/1/2018

NY Unemployment – Providing Proof of PUA Eligibility

Explains the requirement to provide proof of eligibility for PUA

2021 Tax Return and Covid Relief

Some points to note (and discuss with your accountant) when filing your 2021 tax return.

FFCRA: Paid Time Off Work Due to Covid – up to $32k Per Person

How employees and self employed individuals can get paid time off of work due to Covid.

New York State Homeowner Assistance Fund – Up to $50k per Household – Launches 1/3/2021

Up to $50,000 per eligible household, who are either:

– 30 days past due: payment of all arrears

– Have an adult member currently unemployed: six months of future household payments (in addition to arrears).

EIDL $10k (Targeted Advance) + $5k (Supplemental Advance) = Up to $15k Grant

EIDL offers grants of up to $15k per eligible business (including self-employed).

Child and Dependent Care Credit – 2021 Tax Year

Dependent Care Credit offers families with child care and dependent care expenses, up to $8,000 per family in a fully refundable credit.

$10,000 NYC Small Business Resilience Grant

The NYC Small Business Resilience Grant is offering a $10,000 grant to eligible small businesses in New York City, including 1099 / Schedule C applicants.

Beyond COVID – Financial Assistance – Extensive List of Programs

Here is a list of financial assistance currently available in NY.

NY – Hurricane Ida Relief

Resource with available assistance in New York for those who were affected by Hurricane Ida (September 1-3 2021).

Employee Retention Credit (ERC) – For Businesses with Payroll

ERC (Employee Retention Credit) is a Covid-Relief program that gives eligible businesses up to $26k for each employee on payroll.

NY Emergency Rental Assistance Program (ERAP)

This ERA program helps pay the rent for eligible households. Both tenants and landlords can apply. Funds are limited, so if you are eligible, apply right away.

NY Unemployment Update September 6, 2021 – Covid Unemployment is Over

All about Covid Unemployment Expiration on 9/5/2021

NY Child Care Providers – Stabilization Grant

If you have a licensed/registered/exempt child care program, you can get a grant, between $4,000 and $200,000.

NY: Partial Unemployment Now Based on Hours Worked, Not Days

Starting from the week beginning 01/18/2021 partial Unemployment will depend on hours worked and not days worked

Covid-19 Funeral Assistance

FEMA will reimburse up to $9,000 in funeral expenses for people who passed away due to Covid after January 20, 2020.

Free Childcare in New York – Essential Worker Scholarship

The $25 Million NYS Essential Worker Scholarship fund covers childcare costs for essential workers. The term “essential worker” is very broad and includes childcare, education, retail, medical, construction and many more fields.

American Rescue Plan Act – 03/11/2021

Overview of the American Rescue Plan – Signed into law 03/11/2021

Emergency Broadband Benefit – $50 Off Per Month

Federal program that provides a $50 discount on monthly internet bills (or mobile phone plans that include internet), plus a one-off $100 credit for purchasing a device.

EXPIRED: Housing NYC – Section 8 Lottery

Lottery to get a Housing Choice Voucher, commonly referred to as Section 8.

Exclusive PPP Calculator for Businesses with Payroll

This calculator helps businesses with payroll calculate their PPP eligibility.

Restaurant Revitalization Fund (RRF) – Up to $10 Million Grant

Restaurant Revitalization Fund (RRF) is offering up to $10 million to Restaurants, Caterers, Bakeries, Food stands, Bars, and other businesses that serve food.

Shuttered Venue Operators Grant (SVOG) – Up to $10 Million

The Shuttered Venue Operators Grant (SVOG) offers up to $10 million for eligible businesses. There is $16 billion available. Funds may disappear very quickly.

NY: $1,000 Grant – Empire Pandemic Response Reimbursement Fund

The Empire Pandemic Response Reimbursement Fund reimburses $1,000 to income-eligible people who worked for a NY-based “essential business” anytime from March 1, 2020.

How Self-Employed / 1099 Workers Can Get PPP Twice + Calculator

How Self-Employed/1099 can get PPP twice

PPP Eligibility Calculator for Self Employed/1099

Find out how much PPP you are eligible for! Can you get the PPP twice? This calculator is for people who are self-employed or paid via a 1099.

Unemployment and PPP for Self-Employed / 1099 Workers

How self-employed and 1099 workers can access both Unemployment and PPP funds.

Emergency Rental Assistance (ERA)

Emergency Rental Assistance (ERA) helps pay the rent for those who have financial hardships due to the pandemic.

Changes to PPP – Including Self Employed and 1099 PPP Now Based on Gross Income

Application pause for businesses with 20+ employees, more funds for self-employed and 1099 independent contractors, and expanded eligibility to include more businesses

Covid-Relief and Your 2020 Tax Return

With people getting ready to file their 2020 taxes, here are some changes to taxes this year based on the Covid Relief bill. In addition, see how the most common government Covid-Relief programs for individuals are taxed.

PPP Second Draw Application Tutorial – Partnerships

Step-by-step PPP Biz2Credit application tutorial for Partnerships – Second Draw

PPP First Draw Application Tutorial – Partnerships

Step-by-step PPP Biz2Credit application tutorial for Partnerships – Second Draw

PPP Second Draw Biz2Credit Application Tutorial – Businesses with Payroll

Step-by-step PPP application tutorial for Businesses with Payroll – Second Draw

PPP First Draw Biz2Credit Application Tutorial – Businesses with Payroll

Step-by-step PPP application tutorial for Businesses with Payroll

Eligibility Calculator for NY Rent Relief Program – Round Two

Here is an eligibility calculator to help you see if you are eligible for Round 2 of NY Rent Relief

PPP Second Draw Application Tutorial – Self Employed (Schedule C/1099) – No Employees

Step-by-step Second Draw PPP application tutorial for Self Employed and 1099 workers who file a Schedule C

PPP First Draw Biz2Credit Application Tutorial – Self Employed (Schedule C / 1099) – No Employees

Step-by-step PPP application tutorial for Self Employed and 1099 workers who file a Schedule C

PPP Guide for Partnerships (K-1 1065)

This PPP guide is geared to partnerships (K-1 1065)

PPP Guide for Businesses with Payroll

This PPP guide is geared to businesses that run payroll.

PPP Guide for Self-Employed & 1099

If you are self-employed or are paid via a 1099, you are eligible for PPP even if you don’t have any payroll or employees!

Round 2 of PPP – Complete Overview

PPP Guide – Free Cash!

You may be eligible even if you already received a PPP during the first round!

Stimulus Checks – EIP #2

Overview of EIP #2 – Second round of stimulus checks from the new Coronavirus Response and Relief Package, signed into law on 12/27/2020.

Unemployment Changes in The New Covid-Relief Bill (Dec 27)

Here are the changes to Unemployment based on the new Coronavirus Response and Relief PAckage, signed into law on 12/27/2020.

New Covid-Relief Bill – Coronavirus Response and Relief

A brief overview of the new Covid-Relief Bill (Coronavirus Response and Relief)

Is Unemployment Ending? – UPDATE: President Trump Signed The Bill

What will happen to Unemployment based on the current rules and what will change if the new proposed bill indeed becomes law?

NY Rent Relief Program – Round Two

COVID Rent Relief Program covers a portion of the rent for income-eligible people who paid more than 30% of their income as rent during any of the months between April-July 2020.

Cashback: Get Paid Every Time You Shop Online

Cashback programs can save you money every time you shop online.

Stimulus Deadline and Potential Eligibility Change

Deadline for non-filers to claim EIP and change of circumstance in 2020.

Guide How to Submit ID – NY

One of the most common reasons for stalled Unemployment payments is that the DOL needs to verify identity. Here is a guide on how to verify your identity by sending ID documents.

Troubleshooting Your Unemployment Application

Did you apply for Unemployment but are not receiving the money that you are meant to be receiving? This guide is for you.

Becoming Eligible vs Staying Eligible – NY Unemployment

Many people have asked about the difference between becoming eligible for Unemployment and staying eligible in order to get Unemployment payments. Hopefully, this post will clarify any confusion.

Unemployment and Withholding Taxes

This article explains how taxes affect your Unemployment payments.

Calling the Department of Labor – Certifying Missing Weeks

If you tried to certify back weeks by sending a message and did not receive a response, consider calling today.

Effective Days Down to Zero & Benefit Year Ending

If your “Effective Days Remaining” is nearing zero, don’t worry! You most likely will continue receiving Unemployment payments.

Certifying Lost Wages Assistance ($1,800) – NY

All eligible people should receive six weeks of LWA. At $300 a week, that’s $1,800 before taxes.

Most will get it automatically. Some need to certify first.

“Dependent”, Taxes and Unemployment

– A dependent being eligible for Unemployment

– How dependents can get the stimulus

– Filing taxes and potential refunds

Guide How to Get Missing Unemployment Payments – NY

Guide on how to check if you received all eligible payments and how to claim any missing payments.

Don’t Lose Out on $900 (or more) in Lost Wages Assistance

There is a good reason to apply and certify now. Don’t push it off or you risk losing $900 or more.

Please Be Careful If Getting Help to File for Unemployment

Be aware of four things before hiring someone to help you with unemployment.

Extra $300 a Week in Unemployment: Lost Wages Assistance

President Trump signed a memorandum for $300 per week from the federal government, to be given in addition to the regular amount. This is effective from the week ending August 2nd.

Great Covid Resource – ChaiPlus1.com

ChaiPlus1 covers lots of details about various programs and grants, including many that are not covered on HomeUnemployed.com.

PPP (Free Money) ends in two days – August 8th! Got paid via a 1099? Filed Schedule C? You’re likely eligible!

If you are eligible and didn’t yet sign up for the PPP, do it now! It is completely free money for people who are self-employed or run small businesses.

Unemployment Did Not Finish Yet

A few people have asked if it’s too late to apply and if those who already applied should stop certifying their weeks.

No. Unemployment has not finished. PUA has not finished either.

Notice of Determination of Eligibility – Self-Employed in NY

Many self-employed people from New York have asked about a letter they received in the mail from the Department of Labor.

Today is Not the Last Day

Today is not the last day to file for Pandemic Unemployment Assistance.

VIDEO: Teachers & Unemployment

A video explaining how and when teachers are eligible for unemployment during the summer.

Medicaid During Covid-19

Reader Question: If unemployment payments make me no longer income-eligible, am I meant to go off Medicaid? And if I stay on Medicaid, will I have to pay for it?

NYC Rent Relief Calculator

Here is a custom-made calculator for NYC residents so you can see how the eligibility for the NY State rent relief program is calculated.

Don’t Push Off Getting Covid-19 Financial Help!

Today I want to focus on making sure that every single person who needs the financial assistance gets it and doesn’t push it off until it’s too late.

NY State Rent Relief Program

A new program to help New York renters who were financially affected by Covid-19 started today (July 16th 2020), called COVID Rent Relief Program. It covers a portion of four months of rent for income-eligible people who pay more than 30% of their income as rent.

EIDL $1,000 and Unemployment

Reader Question: I am self employed and now on Unemployment. Can I get the $1,000 from EIDL while still on Unemployment?

Received a Letter that You are Not Eligible for Unemployment? Don’t Worry!

Reader Question: I started receiving unemployment but now I received a letter stating that I am not eligible due to not having earned enough wages. Please help!

School Teachers and Unemployment

Reader Question: I work for a school and now finished the school year. Am I eligible for unemployment during the summer?

Difference Between Regular Unemployment and PUA – Why Less Than $182

Reader Question: I thought the minimum PUA was $182. Why am I getting less than that?

Three Ways to Apply in New York

If you already applied for unemployment, great! If not, then this post is for you.

I think I should get more Unemployment

Reader Question: I am receiving unemployment benefits and I think I should be getting more than what the DOL is currently giving me. What are my options?

I heard I need to look for work while getting unemployment. Do I?

Reader Question: When I certified my week I read that there is a requirement to search for work. Do I need to be searching for work?

Payment History Dictionary

A few people have asked what the meaning of some of the words and numbers on the ‘Payment History’ page. So here it goes:

Am I on PUA or Regular Unemployment?

Reader Question: How do I know if I am on regular unemployment or PUA?

Why am I getting only $182 a week?

Reader question: Why am I getting only $182/week in unemployment? I thought I could be getting up to $504/week?

I Never Worked. Am I Eligible for PUA?

Reader Question: I never worked. I want to work now but cannot due to Covid-19. Am I eligible for PUA?

My Claim is Pending! Help!

Reader Question: I applied a few weeks ago. Why is my claim still “pending”? What can I do?

Frequently Asked Questions

Lots of readers have been emailing me questions, so I made a Frequently Asked Questions page.